Article titles that reassure investors–Submit YOUR candidate

Investors crave reassurance during volatile times. But it’s not easy to choose words that steady their nerves. With that in mind, I’m putting out a call for article titles that reassure investors.

Please comment with your candidate for the most reassuring title

If I get enough good candidates in the comments on this blog post, I’ll run a poll, so you can vote for a winner, as discussed in the following Facebook post:

Tom Brakke of the research puzzle blog, one of the early supporters of this contest,

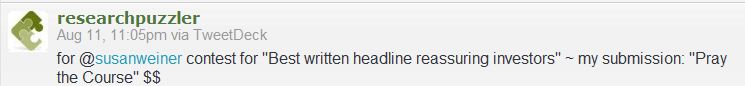

clearly enjoys playing with titles. You can see this in his tweet suggesting “Pray the Course” as a reassuring title.

What makes a title reassuring?

The suggestions by John and Tom show a sense of humor, so I’m going to throw out some serious candidates for reassuring titles. I hope the following titles spark some conversation.

- Downgrade should mean little to long-term investors (Vanguard.com)

- Comfort is rarely rewarded: Maverick Risk and False Benchmarks (Sitka Pacific Capital)

- Intelligent Trading: A Competitive Advantage During Market Plunges (Royce Funds)

- Has the Downgrade Created a Buying Opportunity? (OppenheimerFunds)

What makes a title reassuring? Based on the titles above, I seem to find comfort in titles suggesting I can benefit from–or ignore–market volatility. Right or wrong, this is what works for me.

How about you? What wording do YOU find reassuring?

Aug. 30, 2011 update: I am no longer accepting comments on this post as new candidates for this competition.

“The blessing of balance: A view from Down Under” (Vanguard Investments Australia”:

Robin Bowerman effectively reframes market disturbance into an opportunity identified by the familiar, reassuring concept of “balance,” which also stimulates an image showing mastery of significant shifts.

Thank you, Susan!I’ll have to find this piece.

I’ve received a number of interesting titles via LinkedIn, Twitter, and Facebook, too.

I think we at U.S. Global Investors have done a nice job of continuing to communicate a message of calm. CEO and chief investment officer Frank Holmes quickly put together two good pieces last week to keep long-term investors focused on the important drivers of global markets and discourage relying on headline emotions to dictate investment activity. If there’s one thing we learned during the 2008-2009 crisis, it’s that communicating a clear, fact-based message is absolutely essential during times of turmoil.

Read: Run, Ride or Buy? What Should Investors Do?

http://www.usfunds.com/investor-resources/frank-talk/?i=6285&CFID=3702380&CFTOKEN=81647633

The only headline that would comfort most baby boomers is: “Market soars 1,000 points above 1999 levels and will never dip again. Yes, you can afford to retire!” Since we’ll never be able to publish that headline, however, I think baby boomers want to address the underlying issues. Perhaps, “How to make money whether the market goes up or down,” or “How to invest in a market with a ceiling,” or even “How can I retire after 12 years of range-bound markets?” The article can point out that while the market seems unable to sustain an advance beyond the high point of 1999, volatility since 1999 has offered many opportunities to capitalize on the ups and downs of individual issues and the market as a whole. Even if the market remains range-bound, many savvy investors have used market volatility to their advantage. Greed, a failure rigidly follow a sell discipline, and being unwillingness to hold cash are enemies of this strategy.

Stronger Backdrop for Stocks This Time Around

https://www.tcw.com/News_and_Commentary/Market_Commentary/Insights/08-11-11_Stronger_Backdrop_for_Stocks_This_Time_Around.aspx

Thank you, everybody, for your contributions!

Some folks would find this title reassuring: 5 triggers that will ignite the next bull market (http://www.marketwatch.com/story/5-triggers-that-will-ignite-the-next-bull-market-2011-08-26?dist=afterbell%3Flink%3DMW-FB)