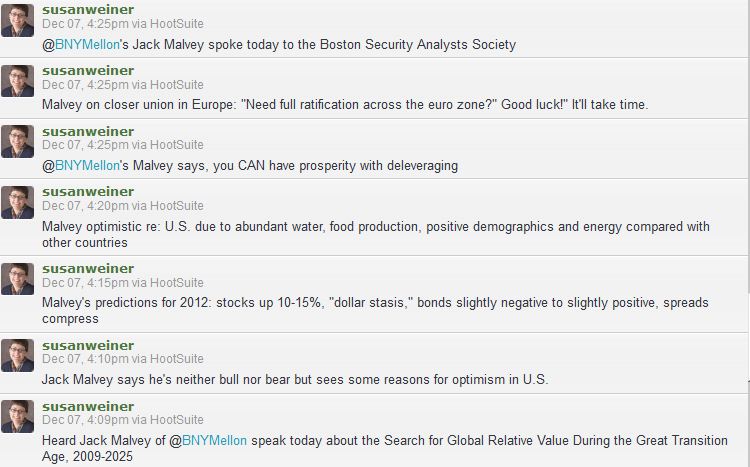

Jeremy Grantham of GMO is a thinker whose words command attention. Financial professionals will read his quarterly investment letters regardless of how well they’re written. But if an unknown strategist delivered the same content, she or he would not benefit from the same indulgence. In fact, few people might have advanced beyond the initial paragraph about his busy schedule. This realization prompted me to think about how I’d rewrite “The Shortest Quarterly Letter Ever,” Grantham’s December 2011 missive.

Financial professionals will read his quarterly investment letters regardless of how well they’re written. But if an unknown strategist delivered the same content, she or he would not benefit from the same indulgence. In fact, few people might have advanced beyond the initial paragraph about his busy schedule. This realization prompted me to think about how I’d rewrite “The Shortest Quarterly Letter Ever,” Grantham’s December 2011 missive.

Headings: An easy fix for bullet point overload

The first two pages of Grantham’s four-page letter consists almost solely of bullet points. It isn’t easy for the human brain to process more than three to six bullet points.

If Grantham didn’t have time to do more than write bullet points, he could have asked a colleague to group his bullet points by topic under a heading. For example, he has a number of bullet points addressing the position of the U.S., which could have been grouped under headings such as

- Challenges faced by the U.S. and the rest of the developed world

- America’s competitive weaknesses vs. other countries

- American social weaknesses

My headings may not be perfect, but they offer more direction to the reader who skims the letter. Right now, the only headings seen by the reader are not informative: “Notes to Myself” and “Recommendations.” Based on these headings, I’d zoom right to “Recommendations,” missing the views that underlie Grantham’s recommendations.

Bold type: Another easy aid to reading

Bold type is another way to help readers distinguish what’s more important.

For example, the following is a sentence I might have bolded in Grantham’s letter:

When one of these old fashioned but typical declines occurs, professional investors, conditioned by our more recent ephemeral bear markets, will have a permanent built-in expectation of an imminent recovery that will not come.

However, this sentence is currently buried in a 15-line paragraph. However, I do like that the paragraph starts with a bolded phrase: “No Market for Young Men.” This phrase helps readers grasp the point that Grantham gradually builds toward in his paragraph. The graph that follows is also helpful.

Massive overhaul

If I had my druthers, I’d rewrite this piece into paragraphs. The piece would start with an introductory overview. It would use headings, and possibly subheadings.

Here’s my quick, bullet-pointed introduction to Grantham’s content, with an emphasis on his strongest point.

S&P Headed for a L-O-N-G Correction

The U.S. stock market could be headed for a 14-year correction, if historical averages for corrections following bubbles hold true. Other negatives for the U.S. include

- Demographics that also plague the rest of the developed world

- Inadequate savings

- The weaknesses in our infrastructure, education, and government

- Social issues, such as greater income inequality

In light of these and other factors, I recommend

- Avoiding low quality U.S. stocks

- Tilting toward safety

- Avoiding duration risk

- Moving slowly into resources in the ground

If you’re not a “Grantham”

If you write investment commentary–and you’re not a strategist of Grantham’s stature–please keep my suggestions in mind as you draft your quarterly market commentary.

You’ll find links to more investment commentary tips in “Resources for quarterly investment commentary writers.”

Feb. 8, 2018 update: I removed the broken link to Grantham’s commentary, which is no longer available online.