NOV. newsletter: Keep your investment commentary fresh!

How do you keep your investment commentary fresh?

Having wrapped up another quarter’s investment commentary, you might be wondering how you can keep your commentary interesting, quarter after quarter. This is especially tough for long-term investors who don’t chase the latest trends.

In my blog post, “Investment commentary – How do you keep it fresh?” I share two techniques:

- Express an opinion.

- Highlight what’s new in an old theme.

Read more at “Investment commentary – How do you keep it fresh?”

Prevent LinkedIn AI from using your content

Generative artificial intelligence (AI) harvests content from across the internet to make itself smarter. LinkedIn revealed earlier this fall that it is using your LinkedIn content to train its AI.

If you don’t want LinkedIn to do that, follow the instructions in “LinkedIn is using your data to train AI. Here’s how to turn it off.” from Mashable.

Memorialize a LinkedIn account

It’s a strange feeling when a LinkedIn search brings up the profile of a friend who has died. It’s even worse when that profile appears active, with no indication that the person is no longer living.

Did you know that it’s possible to close or “memorialize” the LinkedIn account of a dead person? A memorialized account includes a prominent label saying, “In remembrance.” You’ll find instructions at “Memorialize or close the account of a deceased member.”

Enjoy discounted shipping

Thinking about buying and shipping holiday gifts? You’ll pay cheaper rates on USPS and UPS shipping with a free account from Pirate Ship. Using Pirate Ship, I recently saved 20% on mailing a copy of my Financial Blogging book to a buyer. I’ve used Pirate Ship to buy mailing labels to send to people across the U.S. and Canada.

Just create a free account and enter the recipient’s mailing address to find the cheapest or fastest option for your package. Then buy and print a label for your package. You can track your package using the information provided by Pirate Ship. It’s easy!

I don’t have any financial incentive to recommend this to you.

However, if you’d like to give a printed copy of my Financial Blogging book as a holiday gift, email me your shipping address to learn how you can snare one of my remaining copies of Financial Blogging: How to Write Powerful Posts That Attract Clients for only $27 (regularly $49), including shipping within the U.S.

Help your memory

“The best activities for your memory are reading, visiting friends or relatives, going to the movies or restaurants, or walking and going on excursions. It is also cumulative: The more activities, the merrier you will be,” says Barbara Bradley Hagerty in Life Reimagined: The Science, Art, and Opportunity of Midlife.

That’s a lovely prescription for better health.

Halloween pumpkins in Chatham, Mass.

I enjoyed a cute display of pumpkin figures in Chatham, Mass. It appears to be an annual event that starts in mid-October. Check it out if you’re nearby!

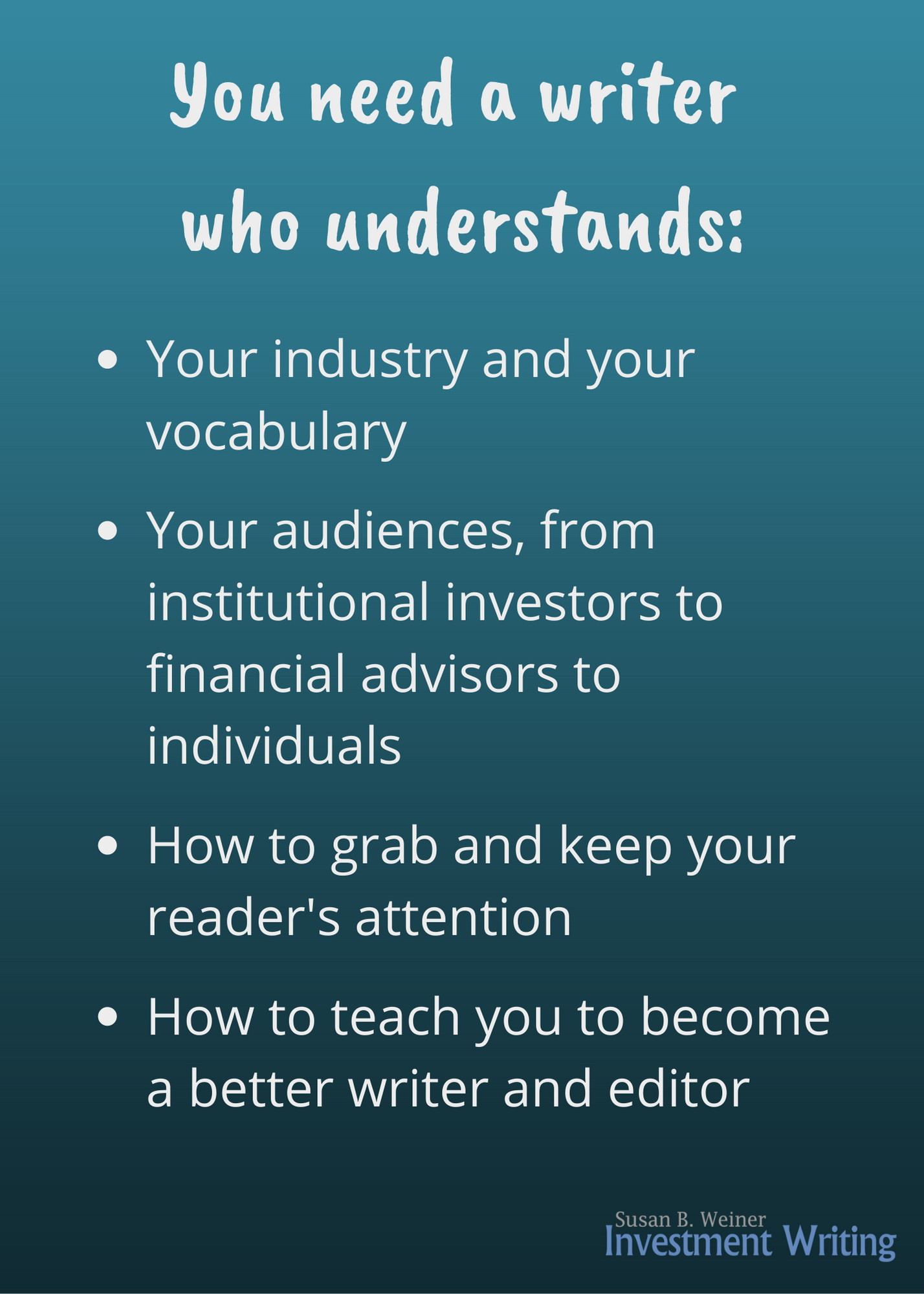

What my clients say about me

“Fast, effective, insightful. I can think of no better resource for superior financial writing.”

“Fast, effective, insightful. I can think of no better resource for superior financial writing.”

“Susan has an exceptional ability to tailor investment communications to the sophistication level of any audience. She has an uncanny ability to make very complex investment and/or economic topics accessible and understandable to anyone.”

“Susan’s particularly good at working through highly technical material very quickly. That’s very important in this business. A lot of people are good writers, but they have an extensive learning curve for something they’re unfamiliar with. Susan was able to jump very quickly into technical material.”

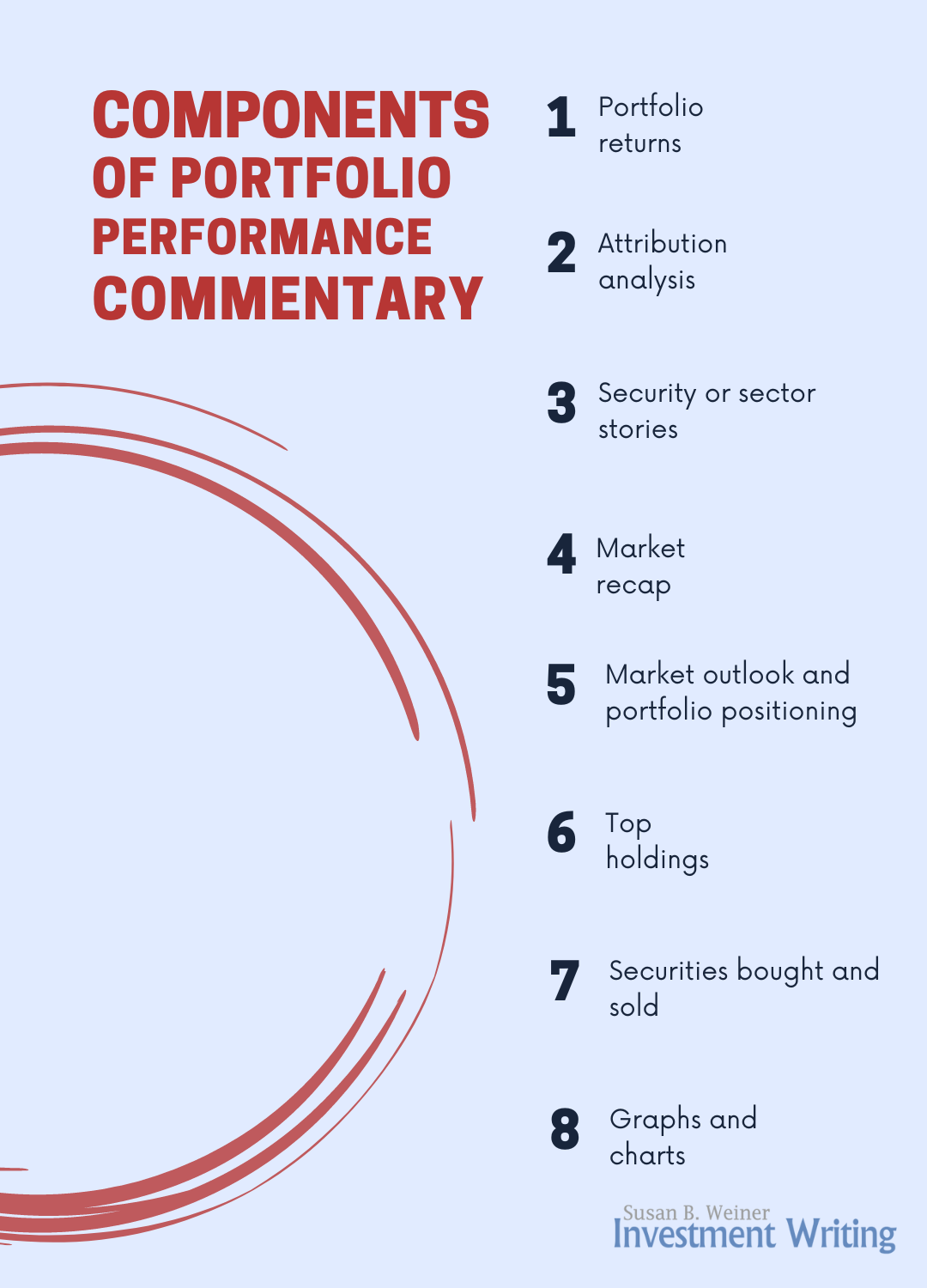

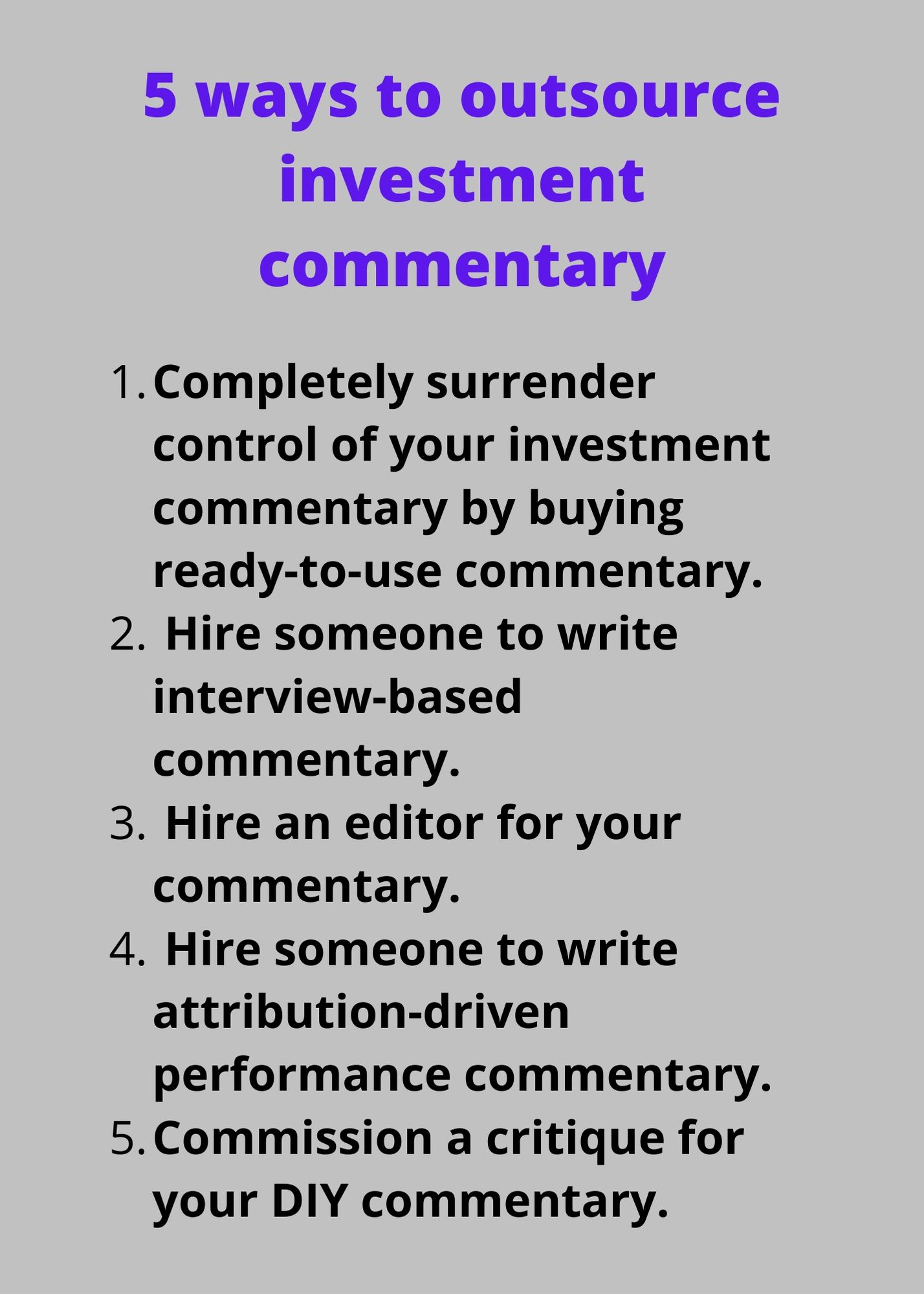

Improve your investment commentary

Attract more clients, prospects, and referral sources by improving your investment commentary with 44 pages of the best tips from the InvestmentWriting.com blog.

Tips include how to organize your thoughts, edit for the “big picture,” edit line by line, and get more mileage out of your commentary.

Available in PDF format for only $9.99. Email me to buy it now!

Boost your blogging now!

Financial Blogging: How to Write Powerful Posts That Attract Clients is available for purchase as a PDF ($39) or a paperback ($49, affiliate link).

Hire Susan to speak

Hire Susan to speak

Could members of your organization benefit from learning to write better? Hire Susan to present on “How to Write Investment Commentary People Will Read,” “Writing Effective Emails,” or a topic customized for your company.