Reader challenge: Propose a new title for this commentary

Titles count. Especially in these days of search engine optimization, better known as SEO. But even without SEO, the quality of your blog post or article title can make a difference in your readership.

Today’s Reader Challenge is coming up with a better title for a piece of published investment commentary: “The ‘Great Recalibration.’ ”

First reactions to “The ‘Great Recalibration’ ” as a title

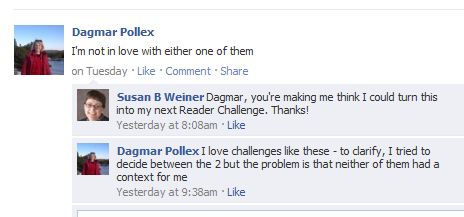

When I skimmed the title “The ‘Great Recalibration,’ ” I couldn’t tell what it was about. Then I read “Volatility in third-party credit ratings heightens the value of proprietary credit research.” Aha. This told me I was reading about bonds and that there might be some useful information in the article. This prompted the Facebook poll you see below.

However, reader comments (see below) on the poll made me think this title provides good fodder for conversation.

Please give your title suggestions below. You’ll probably want to visit the article–at least briefly. I look forward to hearing from you.

Municipals’ Credit Rating Inflation: What’s behind the rating agencies’ recalibration actions and what it means

Thanks, John! I’ll refrain from commenting in the interest of not squashing the conversation.

“Want to See Who’s Swimming Naked? Too Late.”

It has been written that as the tide goes out we get to see who’s swimming naked. But just as the tide of credit quality was receding in the muni markets and we were just beginning to glimpse the tan lines and naughty bits of the worst of the worst, Moody’s and Fitch lowered the shoreline…

(okay, probably wholly inappropriate)

jb

Considering SEO or not? If yes, to highlight Bonds and Municipals, and toss in Housing Bubble:

Bonds: Do you think Municipal Bonds are safer today than before the housing bubble?

Jim Blankenship wins the “Best of the Economic Crisis Black Humor” award hands down.

I like John’s title if these are for articles written to th general public – Municipals’ Credit Rating Inflation: What’s behind the rating agencies’ recalibration actions

People will get it right away.

Will Agency Upgrades Lead to More Downgrades for Munis?

Or

Proprietary Credit Research: A Must a Must in the Muni Market Right Now

Oops…seems to be a posting error:

Proprietary Credit Research: A Must in the Muni Market Right Now

Muni Bond Ratings: Wholesale Upgrades May Hide Specific Issuer Risk

Thank you, everyone! You’re coming up with great ideas.