Reader challenge: Risk management rewrite

It’s time for a reader challenge. How would YOU rewrite the sentence below to make it more compelling and yet stay within compliance guidelines?

Portfolio are managed using the latest risk management techniques.

I’m looking forward to reading your suggestions!

YOU pick the winner: Most reassuring title for investors

Different folks find different titles reassuring amid the stock market’s ups and downs. This is what I’ve  gathered from my call for “Article titles that reassure investors.”

gathered from my call for “Article titles that reassure investors.”

My readers, including connections on LinkedIn, Twitter, and Facebook, and I have submitted the titles you’ll find below. They are listed in alphabetical order.

Please vote for your favorite in the poll that appears in the right-hand column of this blog. If you have a better title, you can add it to the poll.

- 5 triggers that will ignite the next bull market

- A lost decade, really?

- Bernanke Replaced by Harry Potter

- The blessing of balance: A view from Down Under

- Comfort is rarely rewarded: Maverick Risk and False Benchmarks

- Downgrade should mean little to long-term investors

- Has the Downgrade Created a Buying Opportunity?

- How can I retire after 12 years of range-bound markets?

- How to invest in a market with a ceiling

- How to make money whether the market goes up or down

- I love the smell of napalm in the morning.

- Intelligent Trading: A Competitive Advantage During Market Plunges

- It’s Only Money

- Pray the Course

- Run, Ride or Buy? What Should Investors Do?

- Stocks Survive Slumps Time To Buy Soon

- Stronger Backdrop for Stocks This Time Around

- These are the times!

- Volatility does not imply direction – it’s the price we pay for a higher return in the long run.

- We’re not Greece!

- _You can also add your own candidate for most reassuring title.

It’ll be interesting to see which title wins. I wonder what it will say about what we find reassuring.

I will announce the winning title in my October e-newsletter.

Article titles that reassure investors–Submit YOUR candidate

Investors crave reassurance during volatile times. But it’s not easy to choose words that steady their nerves. With that in mind, I’m putting out a call for article titles that reassure investors.

Please comment with your candidate for the most reassuring title

If I get enough good candidates in the comments on this blog post, I’ll run a poll, so you can vote for a winner, as discussed in the following Facebook post:

Tom Brakke of the research puzzle blog, one of the early supporters of this contest,

clearly enjoys playing with titles. You can see this in his tweet suggesting “Pray the Course” as a reassuring title.

What makes a title reassuring?

The suggestions by John and Tom show a sense of humor, so I’m going to throw out some serious candidates for reassuring titles. I hope the following titles spark some conversation.

- Downgrade should mean little to long-term investors (Vanguard.com)

- Comfort is rarely rewarded: Maverick Risk and False Benchmarks (Sitka Pacific Capital)

- Intelligent Trading: A Competitive Advantage During Market Plunges (Royce Funds)

- Has the Downgrade Created a Buying Opportunity? (OppenheimerFunds)

What makes a title reassuring? Based on the titles above, I seem to find comfort in titles suggesting I can benefit from–or ignore–market volatility. Right or wrong, this is what works for me.

How about you? What wording do YOU find reassuring?

Aug. 30, 2011 update: I am no longer accepting comments on this post as new candidates for this competition.

Writing tip: Pop the balloon or make it your focus

A stroll along San Antonio’s River Walk inspired this writing tip because an out-of-place detail grabbed my eye.

A white balloon bobbed along the surface of the river. Once I spotted the balloon, I couldn’t see anything else. Not pale gray stone walls. Not the greens or browns of shrubs and trees. Not the pale blue sky.

Something similar happens to your readers when your blog post, article, or white paper includes details that don’t belong there. They get distracted. They can’t grasp your “big picture” message. Just as I couldn’t absorb the River Walk’s beauty. You can help your readers by popping your “white balloon” to remove distractions from your main message.

Alternatively, sometimes your draft’s “white balloon” is a signal that you should shift your focus to center on the balloon, as I have in this piece–and in the photo below.

Note: This post was edited on August 9 and 23.

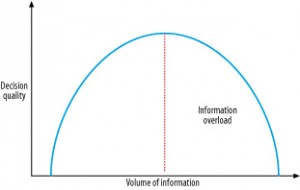

Information density: Weakness or strength?

Are you hitting the right level of information density in your writing?

“Often white papers on technical subjects written for an executive audience have…too much technical detail,” says Robert Bly in The White Paper Marketing Handbook: How to Generate More Leads and Sales with White Papers, Special Reports, Booklets, and CDs (p.16.) Bly’s comment made me think about pieces written by portfolio managers and other financial experts. Their enthusiasm for their topic often gets them bogged down in details.

Benefits first, details later

If you’re a financial professional, remember to focus first on the benefit of your expertise to your readers. Then, you can delve into the details.

Not sure if you have too much detail? Ask an objective member of your target audience for feedback.

Too little data can also hurt

Meanwhile, remember that an absence of detail can also handicap your white paper by undercutting your credibility. As Bly says, often “…white papers written for engineers and scientists have too low an information density (they are too superficial).”

Imagine, for example, you’re trying to sell a new trading system to an investment management system. The president of your prospect company will seek information differently from the company’s head of information technology.

You need to know your audience before you start writing, so you can tailor communications to them.

No batteries required: My favorite blogging technique

If you’re a blogger, you’ve probably struggled to find time to write. Me too.

Blogging on vacation

My favorite place to blog – and to develop a warehouse of posts – is on an unplugged vacation. In fact, I’m writing this post in black ink on a steno pad. My boxy printing and black ink are supposed to make my drafts easy for my typist to decipher. I use a spiral-bound steno pad, so I don’t lose pages.

Blogging offline

I like the slow speed and lack of distractions that come with blogging offline. When I type up a draft, it’s too easy to tinker with my text as I go. Writing in ink – even though I double-space to allow for essential corrections – limits my edits. This is a plus.

Writing offline helps with my focus. It’s just me, my ideas, my steno pad, and my pen. Tough luck for my tweeps. Any brilliant one-liners will be lost to posterity (or obscurity) as I home in on my blog.

Paper fans

I was surprised to learn that I’m not alone. I found more paper fans when I ran a Facebook poll on “Where’s your favorite place to blog?” I suspect that our numbers will decline as technological changes take hold.

P.S. – This was written on a flight to Atlanta, en route to Austin, Texas.

Reader challenge: Rewrite this sentence to make it more powerful

Are you up for a challenge? Try rewriting the following sentence to make it more powerful.

Our firm has managed money for wealthy investors for 33 years.

Reader challenge: Propose a new title for this commentary

Titles count. Especially in these days of search engine optimization, better known as SEO. But even without SEO, the quality of your blog post or article title can make a difference in your readership.

Today’s Reader Challenge is coming up with a better title for a piece of published investment commentary: “The ‘Great Recalibration.’ ”

First reactions to “The ‘Great Recalibration’ ” as a title

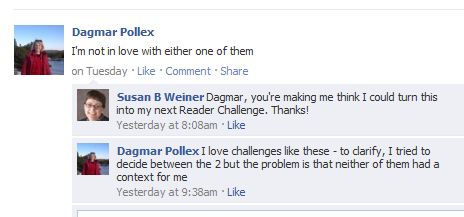

When I skimmed the title “The ‘Great Recalibration,’ ” I couldn’t tell what it was about. Then I read “Volatility in third-party credit ratings heightens the value of proprietary credit research.” Aha. This told me I was reading about bonds and that there might be some useful information in the article. This prompted the Facebook poll you see below.

However, reader comments (see below) on the poll made me think this title provides good fodder for conversation.

Please give your title suggestions below. You’ll probably want to visit the article–at least briefly. I look forward to hearing from you.