Marketing and communications professionals know how to write well. However, sometimes you struggle to get your firm’s executives to recognize the power of good writing. You edit their text, but the execs put the jargon and long-winded, indirect language back in. I have seven tips for how to win over your subject-matter experts.

Note: This post was originally published on Oct. 18, 2013, on the MarketingProfs blog, but it remains relevant today. I have made some updates and additions.

- Use the Oracle of Omaha

When I push for plain language, sometimes my asset manager clients say they’re worried they’ll be seen as “dumb.” That’s not justified.

I tell them to look at Warren Buffett. His annual letter to Berkshire Hathaway’s shareholders relies heavily on plain language. Yet the report is widely discussed by sophisticated financial professionals. I’ve never heard anyone call Warren Buffet dumb because of the way he writes.

Buffett writes like you imagine a trustworthy person would talk. For example, “A number of good things happened last year, but let’s first get the bad news out of the way,” he says on page 3 of his 2012 shareholder letter (PDF). He admits that the firm’s 2012 gains were “subpar.” He says it’s even possible that the firm may lose its record of consistently outperforming the Standard & Poor’s 500 Index over consecutive five-year periods.

It’s easy to imagine a different company burying the bad news at the bottom of the letter or even in the footnotes. Other companies surely would have used stuffier language to convey such news.

Buffett’s style works for various reasons:

- A plainspoken style instills trust in investors. For example, its 2010 full-service investor survey spurred J.D. Power and Associates to recommend boosting investor trust with methods that include honest communication about investment performance and plain explanations for fees and commissions, according to “Study: Why focus on people, not profits, increases investor trust.” On a similar note, “investors are no longer impressed with jargon. They want to understand their investments without learning the definitions to unfamiliar words,” according to “New Word Order,” part of the Invesco White Paper Series (highlights available online). Moreover, “when Invesco tested the phrase ‘institutional-quality money management,’ one focus-group member asked why prison inmates were handling the money,” according to an article in The Wall Street Journal (subscription required).

- The directness of Buffett’s writing saves time for readers. Everybody’s busy. They can save time by reading data-supported statements like this: “Our insurance operations shot the lights out last year. While giving Berkshire $73 billion of free money to invest, they also delivered a $1.6 billion underwriting gain, the tenth consecutive year of profitable underwriting.” Though a securities analyst and a portfolio manager might want to dig into the annual report for more details, these sentences give them a quick idea of what to seek.

- It’s entertaining. Whether you’re an investor, an analyst, or a random reader, you’ll find something to make you smile in Buffett’s reports, which are regularly discussed in articles such as The Wall Street Journal‘s “Warren Buffett’s Annual Berkshire Letter: The Highlights” and, more recently, “I Read All 59 of Warren Buffett’s Annual Letters. These Are the Best Parts.” The author of the latter article says, “Buffett wrote in the voice of a friendly—and sometimes funny—teacher” and points to wording such as “Warning: It’s time to eat your broccoli.”

I imagine that some industry experts would read Buffett even if he wrote terribly; his investment insights are respected. However, weak writing would limit his reach.

- Remind them that longer sentences and paragraphs lose readers

Jargon isn’t the only problem. Research suggests that the longer your writing, the greater the probability that your readers will drop out. The average American starts to lose interest when pieces average more than 42 words per paragraph, 14 words per sentence, and two syllables per word, according to research cited by Ann Wylie of Wylie Communications in Portland, Oregon.

The 42-14-2 rule may be too strict for you, but the bottom line is clear: Longwinded writing is bad for readership. That should be intuitive: Everybody is bombarded with content; and they skim or skip pieces that run long, as the mutual fund prospectus research in the next section suggests.

Don’t believe the research? Here’s what Warren Buffett wrote about his experience reading corporate reports in his preface to A Plain English Handbook: How to create clear SEC disclosure documents: “I’ve studied the documents that public companies file. Too often, I’ve been unable to decipher what is being said or, worse yet, had to conclude that nothing was being said.”

The problem of bad writing is separate from the problem of jargon, because technical terms wouldn’t stump Buffett. It’s probably longwindedness and indirectness that derail him.

- Read out loud

When writers read their work out loud, they get a new perspective on it. I’ve seen that to be the case in my financial blogging class: Students recognize weaknesses they overlooked on a computer screen or printout.

Ask your experts to read their clunky sections out loud. Or, you can read it to them. Then ask, “How does that sound?” You can also suggest reading your edited version of that passage and comparing the “before” and “after.”

Here’s a “before” example:

Proposals from the German/French axis in the last few days have heartened risk markets under the assumption that fiscal union anchored by a smaller number of less debt-laden core countries will finally allow the ECB to cap yields in Italy and Spain and encourage private investors to once again reengage Euroland bond markets. To do so, the ECB would have to affirm its intent via language or stepped up daily purchases of peripheral debt on the order of five billion Euros or more. The next few days or weeks will shed more light on the possibility, but bondholders have imposed a “no trust zone” on policymaker flyovers recently. Any plan that involves an “all-in” commitment from the ECB will require a strong hand indeed.

Did you find it hard to grasp the main point of the “before” paragraph? Now consider the “after” paragraph:

Prices of riskier investments rose in response to recent proposals by German and French leaders, but we are skeptical that this will continue. Investors seem to believe that the proposals will strengthen the euro zone by capping bond yields. This would make euro-zone bonds more attractive to private investors. However, success would require the European Central Bank (ECB) to use strong language or to boost its daily purchases of the troubled countries’ debt by at least €5 billion. To convince distrustful investors will require strong action. That may be more than the ECB can achieve.

In addition to shortening and simplifying, I summarized the paragraph’s main point in the first sentence. Doing so is an easy way to boost reading comprehension. In fact, by simply making that one-sentence change to the “before” paragraph, the author can greatly improve the paragraph’s effectiveness.

By the way, the “before” example is written at the level of grade 16, while the “after” is grade 10, as calculated by Hemingway Editor, which I’ve written about in “Free help for wordy writers!” Think of grade level as a measure of how hard you are making your reader work to understand your message. The lower-grade-level “after” doesn’t sound “dumb.” Rather, it’s clear and confident.

- Plain English boosts results

Research shows that rewriting documents using plain English improves their effectiveness.

According to Joseph Kimble’s Writing for Dollars, Writing to Please, mutual fund buyers found a proposed plain-English “profile prospectus” more appealing than the traditional prospectus. He writes:

In every one of a series of comparisons—including how easy it was to find and understand several important items—the buyers rated the profile prospectus higher than the traditional prospectus. What’s more, most of the buyers had not even read the traditional prospectus before investing; but 61% of that group said they would be very likely to read the profile prospectus.

Respondents to an Investment Company Institute survey (PDF) on the profile prospectus revealed that “Investors overwhelmingly considered the writing style of the profile prospectus superior to that of the [traditional] prospectus.” They also liked the profile prospectus better for making purchase decisions, locating specific information, and comparing funds.

Profile prospectus research conducted by fund companies showed that financial advisers also liked the layout, length, and content of the profile prospectus and would use it with investors. Unfortunately, this simpler overview of funds was not adopted because of fund company concerns about costs and liability. However, a similar document, called a “summary prospectus,” was adopted in November 2008 with the mutual fund industry’s support.

- Show them you can work with the compliance department

Some bad writing results from fear of the firm’s compliance department. Under SEC and FINRA oversight, nobody wants to make a mistake. Here’s an example of the kind of clunkiness that results:

In the investment decision-making process, it has been demonstrated that the most important element affecting future portfolio performance is the asset mix.

I suspect that the use of “it has been demonstrated” comes from the desire to fend off a compliance officer’s complaint that there’s no proof that the asset mix is so important. The same may be true of the reference to “future” performance, because a hair-splitting compliance officer might point to the many times when factors other than asset mix play an outsized role in investment returns.

However, you may be pleasantly surprised by how open your compliance professionals are to your efforts to write well while also satisfying their concerns. After all, they benefit if readers understand what both of you are trying to say.

I suggest that first you write your message clearly. The sample sentence above might become “The investment decision that has the most impact on portfolio performance is the asset mix” or “A portfolio’s asset mix has the greatest impact on performance.” This could cut the sentence’s length from 23 words to as few as 10 words.

Next, consider ways to satisfy the compliance department’s concerns. It may be enough to document the importance of the asset mix by listing links to academic articles in the marketing department’s compliance files or in a footnote to the document. If your overseers demand more information in your publication, remember that you don’t need to jam it all into one sentence. A less prominent position in the same paragraph should work.

- Turn the tables

Your troublesome executive may be more open to recognizing problems in other people’s writing. That gives you an opening. Try showing them before-and-after examples of somebody else’s writing. You can use the examples given earlier in this article or something more relevant to your firm.

When an executive recognizes the value of streamlining someone else’s writing, you will have an opening to discuss the exec’s writing.

- Be tactful

Tread gently when you edit your subject-matter experts’ work. Suggest changes rather than offering criticism. That’s less threatening to fragile egos. Also, a wise writing coach talks about the writing, not the writer. It may also help to position your rewrite as “alternative” wording rather than a “better” approach.

It’s not easy for anyone to break a lifetime of bad writing habits. My tips could help you nudge someone in the right direction. As a starter, share this article and ask for your subject-matter experts’ advice on how to boost the effectiveness of your firm’s communications. Enlist them as your partners in better marketing.

“Fast, effective, insightful. I can think of no better resource for superior financial writing.”

“Fast, effective, insightful. I can think of no better resource for superior financial writing.”

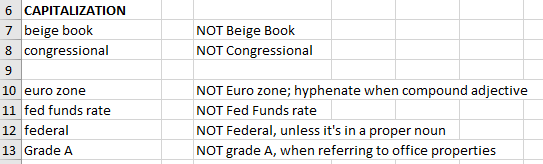

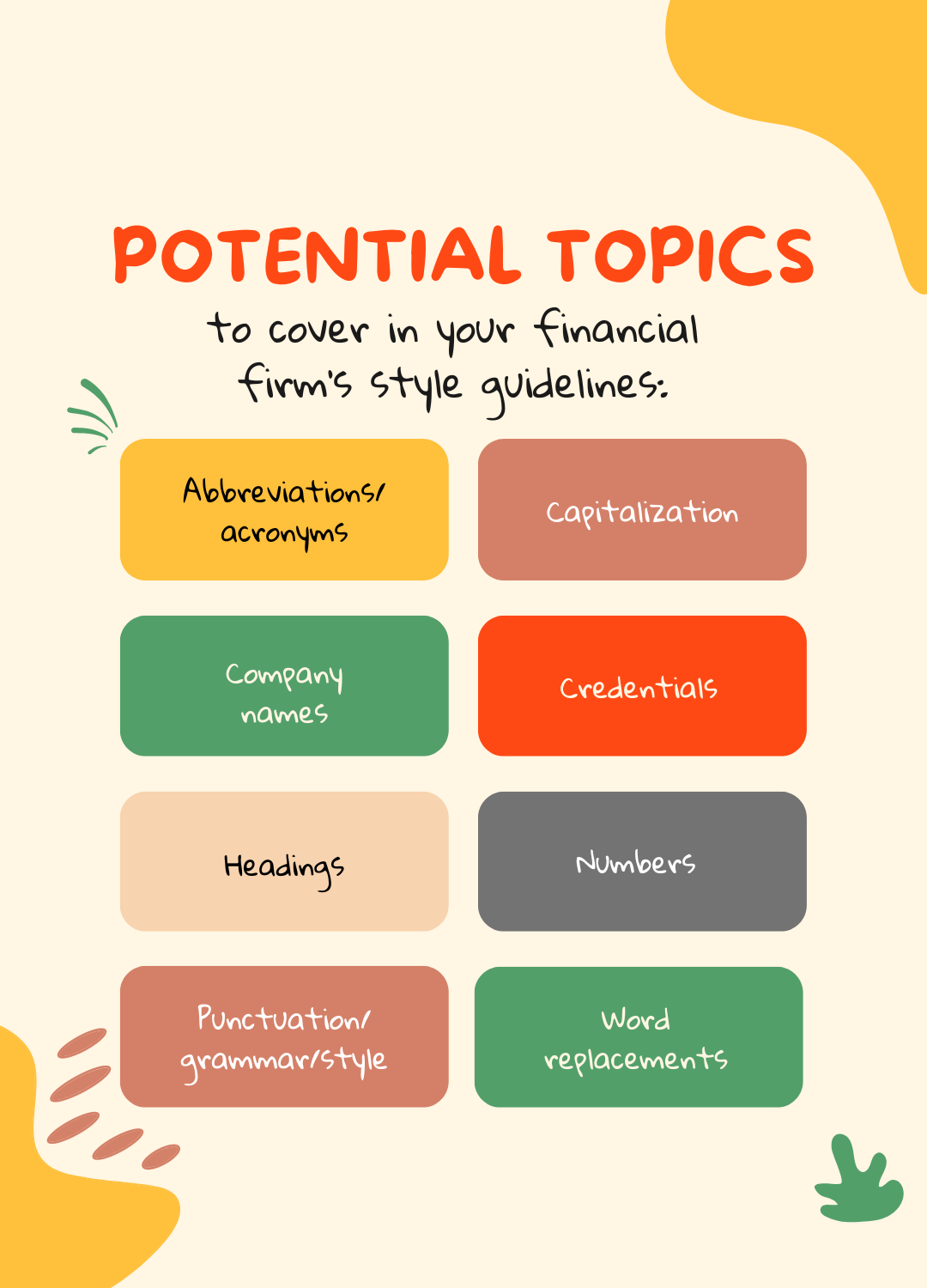

It can be distracting if writing styles are inconsistent within and across documents published by your firm. For example, is it “counterparty” in the first paragraph and “counter party” in paragraphs two and three? Do headings randomly mix sentence case and title case? Is your company name abbreviated in different ways?

It can be distracting if writing styles are inconsistent within and across documents published by your firm. For example, is it “counterparty” in the first paragraph and “counter party” in paragraphs two and three? Do headings randomly mix sentence case and title case? Is your company name abbreviated in different ways?

Keep my practical writing tips handy with my two PDF e-books.

Keep my practical writing tips handy with my two PDF e-books.

Hire Susan to speak

Hire Susan to speak