Guest posts can launch investment and wealth managers into the blogosphere. This follow-up to “How to guest-blog on personal finance or investments, Part I” gives you names of blogs to target for guest posts.

It has been 10 years since I originally posted this list, so I recently reviewed it to update links and to comment on blogs that no longer accept guest posts.

Investment blogs that accept guest posts

The granddaddy of investing blogs is Seeking Alpha, which you can join as a contributor. Its website says “Over 17,000 people have contributed articles over the years. These include individual and institutional investors, fund managers, analysts, college students, retirees, and all those who enjoy sharing investment insights and ideas with our community.”

Advisor Perspectives isn’t a blog. But it publishes similar content. Its submission guidelines say it publishes

…market commentaries submitted to us by participating fund companies, independent research firms and advisors. Selected commentaries are promoted to subscribers of our daily Research Perspectives newsletter.…We offer two levels of service: our free Basic Commentaries, and our paid Featured Firm Commentaries.

Disclosure: I have occasionally written for Advisor Perspectives.

Enterprising Investor, the blog of the CFA Institute, accepts guest posts from non-members, as well as from CFA charterholders, according to its Contributor FAQs. Posts should run 600 to 1200 words and be aimed at investment professionals.

Personal finance blogs that accept guest posts

Wise Bread, which reports receiving 1.8 million page  views monthly, discusses why and how to apply to be a guest blogger on its “Write for Wise Bread” page. Thanks to Aaron Pinkston of Clarifinancial for bringing this site to my attention.

views monthly, discusses why and how to apply to be a guest blogger on its “Write for Wise Bread” page. Thanks to Aaron Pinkston of Clarifinancial for bringing this site to my attention.

Jeff Rose of Good Financial Cents likes Wise Bread, too. He also shared the names of  additional blogs where he has been a guest. However, as of April 2020, Get Rich Slowly, Consumerism Commentary, and Cash Money Life no longer accept unsolicited guest posts.

additional blogs where he has been a guest. However, as of April 2020, Get Rich Slowly, Consumerism Commentary, and Cash Money Life no longer accept unsolicited guest posts.

Here’s a personal finance blog that still accepts guest posts:

Other blogs worth targeting

Your business niche may also have blogs that will accept your posts and help you educate your target audience.

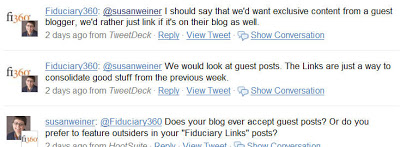

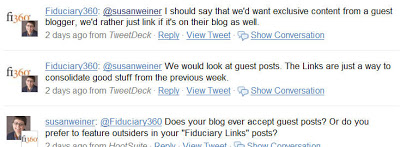

Through my work with fiduciary advisors, I’ve become familiar with the fi360 blog. The firm told me in April 2010 that guest posts may be possible. However, “I should say that we’d want exclusive content from a guest blogger. We’d rather just link if it’s on their blog as well.” When I followed up in 2016, @fi360 tweeted “We are always interested in guest bloggers. Please feel free to send any posts to fi360@fi360.com.” Here’s a sample guest post, “Good Insurance Decisions Require Appropriate Information.”

Interested in getting read by your colleagues? Michael Kitces’ Nerds Eye View has a knack for attracting attention among practitioners. In a June 2011 email, he told me, “My guest blogging posts are not by invitation only. I am open to people contacting me with ideas. However, as you’ve probably noticed, I do have a certain edge and focus to the types of posts I put up, so I am looking for content that is consistent.” Since we originally spoke, Michael has published guest post guidelines.

The Slott Report is open to guest posts. “We already have over 500 articles on IRA, tax and retirement distribution planning on our site. We also accept posts on Social Security and Medicare planning. We don’t post investment related posts, but more on the planning and distribution side,” said The Slott Report’s Jason Trexler when we traded emails in 2016. “All guest posts are allowed a 50-word brief professional/company bio and URL hyperlink at the bottom of the article..” Here’s a sample guest post: “Avoid This Trap When Using a Roth IRA to Pay For College.” Read “Become a guest contributor.”

Another potential target: your local newspaper’s blog. Its reach may be small, but it could yield some great prospects close to your office.

What else?

Have I missed any great tips for guesting between this post and my earlier post on this topic? Please chime in. I’d like to learn from you.

Post updated on June 3, 2013; Feb., 8, 2016; and April 24, 2020.