Do I need to use the (r) mark with my CFP designation?

“Do I need to use the ® mark with my CFP designation”? This question spurred me to do some research on whether one must always write “CFP®.”

“Do I need to use the ® mark with my CFP designation”? This question spurred me to do some research on whether one must always write “CFP®.”

When I was active as a reporter, I never used the ® mark. In fact, I rarely included an interviewee’s CFP designation because space was tight.

Upon doing research, I discovered that the rules for me as a reporter and blogger differ from the rules for you as a CFP certificant.

If you’re using your CFP designation in sales or advertising

Here’s what The Chicago Manual of Style says on its website:

Q. Is it proper or necessary to use the circled R each and every time the registered trademark name is used in a document? What is the correct usage for the symbol?

A. In publications that are not advertising or sales materials, all that is necessary is to use the proper spelling and capitalization of the name of the product. A trademark attorney can tell you when the use of the symbol is required.

From a legal standpoint, the key seems to be whether you’re using your designation in something that might be considered advertising.

The CFP Board’s stance on “CFP®”

It appears that the CFP Board would like the circled R to appear with every use of the CFP mark, with the exception of “CFP Board.” As it says in its guidelines, Certified Financial Planner Board of Standards Inc. (CFP Board) is a company name or trade name, not a trademark, and therefore is not required to be displayed with the ® or ™ symbols.”

You can read general guidelines—and download detailed instructions—on the CFP Board’s website.

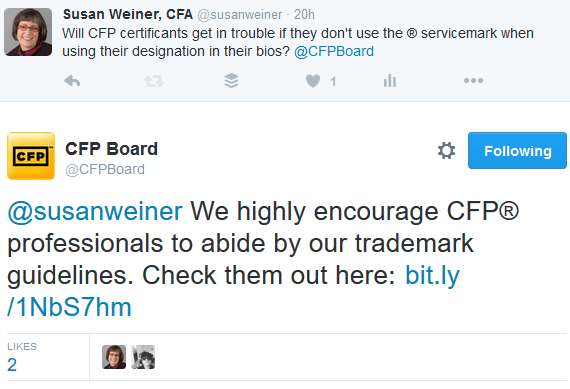

Will you land in trouble if you don’t abide by the guidelines? Maybe not, but do you want to annoy the body that issues a credential that’s important to you? Here’s the CFP Board’s response to my tweet on the topic.

By the way, the CFP Board also has rules about what words you bundle together with “CFP®.” They ask you to use:

…one of CFP Board’s approved nouns (“certificant,” “professional,” “practitioner,” “certification,” “mark” or “exam”) unless directly following the name of the individual certified by CFP Board.

CFP practices at some big firms

For the heck of it, I searched “CFP” on the Merrill Lynch website. It yielded a sea of “CFP®” references. I didn’t see any CFPs without the mark.

The CFP certificants who popped up in a search on the Ameriprise Financial website also used the registered mark.

What about the CFA?

Doing this research made me worry about whether I’m supposed to use a mark when I write “Susan Weiner, CFA.” I learned that my current usage is fine, but there are cases where the CFA Institute would like me to use the mark.

Here are some examples of proper usage from the CFA Institute’s web page about trademark usage:

- John Smith is a CFA® charterholder.

- Amy Jones, CFA, is a portfolio manager.

- John Smith is a holder of the right to use the Chartered Financial Analyst® designation.

For more on the proper use of this designation, visit the CFA Institute’s page about trademark usage.

What about the CPA?

I researched the CPA credential when copyediting bios for a client. The AICPA seems to allow either Certified Public Accountant or CPA.

Your firm’s biographies

Doing this research made me realize that you should research the trademark status of the designations held by your financial firm’s employees. With research, you can make sure your firm’s bios conform with the rules.

Step 1: Find an article (or other short piece) about which you have strong feelings

Step 1: Find an article (or other short piece) about which you have strong feelings