In the News

Could a goal buddy help you grow your writing business?

When I took a marketing class for writers, I didn’t know I’d walk away with not only someone to help me with my business but also a close friend. Weekly check-ins have helped both of us work through challenges and have also allowed us to develop a friendship. “I’ve focused my goal buddy relationship on running my business, but you can pick another focus. For example, you might use it to help you blog,” I say in an article for the American Society of Journalists and Authors, “A Goal Buddy Can Boost Your Writing Business” (February 2024).

Using ChatGPT to see things from a new perspective

Many writers are understandably wary of generative artificial intelligence applications like ChatGPT. On the positive side, I’ve found a way that it can help us to think differently.

“I didn’t use any of the words that ChatGPT generated, but they helped shake my brain out of thinking in highly technical terms,” as I explain in an interview with Anne Miller, “Jan. Metaphor Minute: Shake Up Your Brain” (January 2024).

Celebrating NAPFA’s 40th anniversary

“I am proud to be associated with NAPFA,” as I say in my NAPFA Advisor (December 2023) column, “A Look Back at NAPFA’s Illustrious History.” Over the past 40 years, NAPFA has grown and established itself as a leader among fee-only advisors. Click on the link to read Q&As with many NAPFA leaders and friends of NAPFA.

Much to live for and much to live on

In my column for NAPFA Advisor (November 2023), “Retirement and Taxes,” I report on how this month’s articles relate to the saying that “Retirement is wonderful if you have two essentials—much to live on and much to live for.”

NAPFA Advisor releases generative AI policy

I’ve created a generative artificial intelligence (AI) policy for the NAPFA Advisor. In short, don’t use it when writing for the magazine. “NAPFA is placing strict limits on the use of generative AI in creating articles for the magazine. This is because of the risk of plagiarism, copyright violations, bias, inaccurate information, and other problems that may accompany the use of generative AI tools such as ChatGPT,” as I say in my NAPFA Advisor (October 2023) column, “The NAPFA Advisor’s New Policy on the Use of Generative AI by Contributors.”

NAPFA Fall Conference highlights

In October, NAPFA held its fall conference in Louisville, Kentucky. The keynote speakers covered topics ranging from artificial intelligence to the economy, focusing on the future of financial planning.

In “NAPFA Fall Conference Keynotes Discuss Economic Outlook, AI, Fintech” in the November NAPFA Advisor, I report that Professor Ajamu Loving said that financial advisors should not fear AI. “That’s because they fall into two categories identified by futurist Michio Kaku as safe from AI-related job loss: jobs that involve imagination or conceiving of something that didn’t exist before and jobs that involve strategy, meaning coming up with a course of action based on amorphous information.”

NAPFA celebrates outstanding contributors to financial planning in 2023 awards

In “Meet NAPFA’s 2023 Award Recipients!” in the September NAPFA Advisor, I share Q&As with seven NAPFA members for which I created questions and edited answers.

Looking ahead to the NAPFA Fall Conference

Last year, a resolution to practice meditation breathing exercises more regularly led me “from participating once or twice a week to participating three to six days a week, either with my group, with an online app, or in another meditation group.” I’m looking forward to what the NAPFA conference will bring me this year, and I talk more about my excitement in “Unexpected Benefits of a NAPFA Conference,” my column in NAPFA Advisor (September 2023).

How to use technology to make the writing process easier

As writers, we’re always looking for ways to make the writing process easier. From helping with brainstorming to proofreading, technology can be a great asset. But, as I say in my NAPFA Advisor (August 2023) column, “Technology to Help You at Every Step of the Writing Process,” “Automated tools often make mistakes. If you’re not confident in your grammar and style skills, hire a human editor. Or at least be familiar with reputable grammar resources.”

Are there any specific authors or topics you’d like to see?

In my column for NAPFA Advisor (July 2023), “Going on a Treasure Hunt,” I write about the process of finding authors and topics: “Have you ever gone on an extended hunt to find a professional to serve as a resource for your practice or your personal life? That’s a regular part of my job as editor of the NAPFA Advisor.”

4 tips to make your writing more precise

Sometimes your message can get lost in overly complicated language, so it’s important to make your writing as clear as possible. One tip I give in my column in the NAPFA Advisor (June 2023), “Is Your Writing Too Wordy? These 4 Tips Can Help,” is that “Every writer can benefit from a second set of eyes.”

NAPFA keynote speakers look ahead

“‘The antidote to #AI is to double down on being human. It’s the one thing AI will never be able to do,’” says NAPFA Spring Conference speaker David Allison. Learn more about the May conference presentations in “Looking Ahead with Keynote Speakers,” an article in the NAPFA Advisor (June 2023).

Should I get pet insurance?

When talking about insurance, it’s important to remember our furry friends. There are many factors to consider, like the “Cost of insurance premiums vs. cost of medical care,” “Age, health, or life expectancy of the pet,” and “Client’s ability to pay pet’s medical bills,” which I discuss in “Pet Insurance Can Help,” my column in the NAPFA Advisor (May 2023).

3 techniques to counter microaggressions and macroaggressions

“NAPFA members can support diversity, equity, and inclusion (DEI) in many ways,” as I say in “How to Counter Microaggressions and Macroaggressions,” my column in the NAPFA Advisor (April 2023) about ways to counter microaggressions and macroaggressions.

Are AI writing tools useful?

“Proceed with caution when using AI writing tools,” as I say in “Members Skeptical but Interested in AI Writing Tools,” my column in the NAPFA Advisor (March 2023) about writing tools that use artificial intelligence (AI). The tools have many weaknesses, including potentially using inaccurate information, violating copyright, and lacking creativity. On the other hand, these tools can help if used with an awareness of their weaknesses.

NAPFA presenters make great authors

“I like to invite conference presenters to write for the magazine because the conference organizers stamped their approval on their topics as interesting to members,” as I say in “The Long-Term Value of NAPFA Conference Sessions,” my column in the NAPFA Advisor (February 2023). I’m always looking for more authors and topics.

Welcome new and returning columnists

“The magazine is happy to welcome new and returning columnists, and we’re also grateful to former columnists for their many contributions,” as I say in “Welcoming New and Returning Columnists,” my column in the NAPFA Advisor (January 2023).

Look ahead, not behind

“It’s so helpful to keep longer-term goals in mind and to monitor one’s progress toward them,” as I say in “Looking ahead,” my column in the NAPFA Advisor (December 2022). Recently, I’ve found it useful to add a three-year goal to my quarterly reviews.

Highlights from the NAPFA Fall Conference

In a November NAPFA Advisor article, I highlighted some lessons that attendees at the NAPFA Fall Conference learned about “diverse topics that can help them help their clients and run their practices more efficiently and effectively.”

Your clients are aging—and so are you

I identify some useful books about aging in “Reading about old age,” my column in the NAPFA Advisor (November 2022). No matter in what role you interact with older people, “It’s important to be aware of your assumptions and potential misconceptions about older people.”

Financial marketing and process

“Recent articles in the NAPFA Advisor have reminded me of the importance of process to your marketing. It’s important in two senses: first, as something you communicate about and, second, as something you embrace in creating your marketing,” as I say in “Process matters,” my column in the NAPFA Advisor (October 2022).

Collecting testimonials for marketing

Now that advisors can use testimonials in their marketing, I suggest “Lessons from my experience with testimonials” in my column in the NAPFA Advisor (September 2022). The first lesson is to get help in collecting testimonials.

Hands-on insights on technology

“It’s one thing to have a tech firm tell you its product is the greatest thing ever, but it’s something else when a peer tells you how they use it,” as I say in “Focus on technology,” my column in the NAPFA Advisor (August 2022). That’s why you’ll benefit from the advisor-written articles on technology in this issue of the magazine.

Lead magnets are only the beginning

Don’t just contact prospects once. Repeated, consistent follow-up with those who respond to your lead magnets and other marketing content is essential, as I explain in “Follow-up is essential to attract new clients,” my column in the NAPFA Advisor (July 2022).

Inspiration for articles

I explain how I find writers and topics for the magazine in “How NAPFA conferences lead to relevant magazine articles,” my column in the NAPFA Advisor (June 2022).

The outward mindset

“Outward organizations have members who collaborate, innovate, and are engaged,” as I say in “Look outward, say conference keynoters,” my article about NAPFA’s spring conference, in the NAPFA Advisor (May 2022).

Moving to digital

“Going completely digital allows the magazine staff to include more links in articles,” as I say in “Transition to the NAPFA Advisor’s new digital edition,” my column in the NAPFA Advisor (May 2022).

Gender pronouns

“…we can avoid causing discomfort by removing gender from our sentences,” as I say in “Recognizing gender diversity and related pronouns,” my column in the NAPFA Advisor (April 2022).

Get ready for your on-screen appearance

“Solid colors are your safest choice,” as I say in “How to dress for an on-screen appearance,” my column in the NAPFA Advisor (March 2022).

Nervous about hiring a freelance writer?

“Your writing projects will be more successful if you figure out some key parameters before contacting writers,” as I say in “Define your needs for your freelance writer,” my article in the NAPFA Advisor (March 2022).

Thank you, columnists and authors!

“Member-authors can fill the role of columnist with an annual writing commitment or write articles when they feel inspired or when they’re kind enough to respond to my calls for articles,” as I say in “Thank you, columnists and authors!” my column in the NAPFA Advisor (February 2022).

Turn CPAs into referral sources

“Many financial advisors take the wrong approach to seeking referrals from CPAs,” said Steven Jarvis, CPA, of Retirement Tax Services in his NAPFA Fall Conference presentation on “Delivering Massive Client Value Through Tax Planning in 2021.” In “Turn CPAs into referral sources,” I describe three ways you can more effectively cultivate CPAs as referral sources.

Don’t have a continuity plan? Start creating one now

“Putting the pieces in place for your continuity plan will position you to better tackle your succession plan,” as I say in “Don’t have a continuity plan? Start creating one now,” my column in the NAPFA Advisor (January 2022).

The difficulty of predicting the future

“…we should pursue our personal and business goals with open eyes. We may take our goals in unexpected directions,” as I say in “The difficulty of predicting the future,” my column in the NAPFA Advisor (December 2021).

Annual FLX Gift Guide

My book, Financial Blogging: How to Write Powerful Posts That Attract Clients, is featured in the “Annual FLX Gift Guide” in the weekly newsletter of Freelance Success (Nov. 17, for subscribers only).

Living with an older family member

“Try to appreciate the good times,” as I say in “Living with an older family member,” my column in the NAPFA Advisor (November 2021).

Tips for podcasting

It’s not too later to start podcasting. “You still have a chance to stand out,” as I say in “Tips for podcasting,” my column in the NAPFA Advisor (October 2021).

Lessons from the pandemic

“The pandemic has been a time of sorrow and uncertainty,” but I’ve been lucky to find some positives amid it, as I say in “Lessons from the pandemic,” my column in the NAPFA Advisor (September 2021).

Are you taking advantage of this magazine’s technology?

If you’d like to read or search back issues of the NAPFA Advisor, NAPFA’s monthly magazine, please visit napfaadvisor-digital.com,” as I say in “Are you taking advantage of this magazine’s technology?” my column in the NAPFA Advisor (August 2021).

Reboot your LinkedIn profile for better marketing!

“LinkedIn gives you about 200 characters to grab the viewer’s attention. Don’t just put your job titles there,” as I say in “Reboot your LinkedIn profile for better marketing!” my column in the NAPFA Advisor (July 2021). My column sums up some practical lessons from a NAPFA conference presentation by consultant Kevin Knebl.

Writing opinionated market commentary for clients

“In my opinion, if you’re going to discuss the markets, you should go beyond saying, ‘The S&P 500 returned X.XX%, and the Barclays Bloomberg Aggregate Index returned Y.YY%,’” as I say in “Writing opinionated market commentary for clients,” my column in the NAPFA Advisor (June 2021).

The potential impact of federal legislation on financial planning

The NAPFA Spring Conference highlighted the potential impact of federal legislation on financial planning. I give you the low-down in my NAPFA Advisor column (June 2021).

How topics and authors end up in the NAPFA Advisor

“I’m always on the prowl for great article ideas,” as I say in “How I found authors and topics for this issue,” my column in the NAPFA Advisor (May 2021).

How to generate ideas for blog posts

If you’re starting a blog for your firm, there’s an easy way to generate topics that will interest your clients and prospects. I talk about it in “How to generate ideas for blog posts—and great efficiency” in the NAPFA Advisor (April 2021)

How to find your racial blind spots

“The way we discriminate against people today is different than how our ancestors did it; it’s not overt,” as I learned from a Zoom workshop on implicit bias led by Dr. Mahzarin Banaji, author of Blindspot: Hidden Biases of Good People. I discuss this in “Hidden biases of good people,” my column in the NAPFA Advisor (April 2021).

Sharing useful tips makes you look good to clients and prospects

“By highlighting your strategic alliance partners’ expertise, you give them an incentive to share information about you, including your video that makes them look good,” as I say in “Marketing tips for video and more,” my column in the NAPFA Advisor (March 2021).

Documents alone aren’t enough

“Conversations about what happens after death are important because legal documents can’t control everything. And sometimes, heartfelt wishes don’t make it into documents,” as I say in “Create or update those estate planning documents!” my column in the NAPFA Advisor (February 2021).

Your physical and mental well-being

My January 2021 e-newsletter was the source of a tip to check out Buy Nothing groups, which appeared on SBV Curated Content (Jan. 13, 2021).

Things aren’t always as they seem

QuoteInvestigator.com is a useful site for checking the origins of well-known quotations. I mentioned it in my column in the NAPFA Advisor (Jan. 2021).

Big Ticks: The Best Stories For Professional Advisers This Week

Tony Vidler refers to “a couple of very quick and excellent tips here on taking control of your own content” in my 2014 post, “Ouch, LinkedIn, why did you do that to me?” (Oct, 10, 2020).

Spotlight: Meet Susan Weiner of Investment Writing

“The world’s best ideas don’t mean anything if you can’t move people to act on them,” as I say in this Q&A on the Out & About Communications blog (Sept. 3, 2020). That’s why I recommend that new professionals learn to communicate well.

Get the most out of a virtual conference!

Do you miss the networking opportunities offered by traditional in-person conferences? Learn my tips for networking—and how to avoid distractions—when attending a conference on your computer. I shared my tips in the NAPFA Advisor (September 2020).

How advisors can fight racism

In my NAPFA Advisor column, NAPFA members share their advice for how advisors and their firms can fight racism (August 2020).

How 4 ASJA Members Coped

My ways of coping with the uncertainty of COVID-19 are included in this ASJA Magazine article (Summer 2020, accessible only by members). One of my techniques is to start a “find your focus” thread for my writer friends on Facebook.

Helping clients manage budgets and money after the viral outbreak

About half of the advisors whom I surveyed said that their clients’ income and spending fell in the aftermath of COVID-19, as I reported in the NAPFA Advisor (June 2020).

Education versus experience

As I wrote in my NAPFA Advisor column (May 2020), “Folk singer Pete Seeger reportedly said the following: ‘Do you know the difference between education and experience? Education is when you read the fine print; experience is what you get when you don’t.’ The fine print is important for many aspects of our lives. However, it seems to me as if it is particularly applicable to insurance, a theme of this month’s issue. I quickly get tired whenever I read an insurance policy. However, I’m afraid that my lack of education about insurance is making me overlook something important. This is why I think it’s important to be well-educated about insurance.”

Invest in knowledge with NAPFA

Some of the techniques that financial advisors should use in client communications during a crisis, according to Jay Mooreland of the Behavioral Finance Network, are to:

- Tell clients what’s possible, including the fact that things may get worse.

- Help clients to look ahead five years. In five years, coronavirus may be just a memory.

- Tell clients what you’re going to do. You may not act right away, but surely soon you will rebalance portfolios to fix asset allocations that have gotten out of whack.

I discussed Mooreland’s comments in my column in the NAPFA Advisor (April 2020).

Help your aging clients

“Almost three-quarters of advisors report providing clients with information on aging and cognitive decline, but less than 20% of clients report having those conversations. This was a startling statistic from NAPFA Fall Conference speaker Amy Florian’s session on “Your Aging Client: Prepare for Inevitable Issues, Diminished Capacity, and Elder Fraud.” Could a similar gap exist between you and your clients?” I tackled how to help aging clients in my column in the NAPFA Advisor (March 2020).

Typos matter

“Would you open an email with the subject line ‘Decisiomakers contacts’? That’s an actual email that entered my email inbox. You might skip the email because you’re not interested in buying lists. Or, in a decision more relevant to this column, you might figure that the misspelling of ‘decisionmakers’ makes it more likely the email is spam.” I share helpful tips in my column in the NAPFA Advisor (February 2020).

Mind mapping as a tool

“Because it’s so helpful, I use mind mapping at multiple steps of the writing process.” I give a brief overview in my column in the NAPFA Advisor (January 2020).

Diversity at the NAPFA conference

“Seventy-seven percent of the emerging generations say that a company’s level of diversity affects their decisions about working there. Thus, diversity helps attract, retain, and engage younger employees,” as I reported in my column in the NAPFA Advisor (December 2019).

Weekend Reading for Financial Planners (Dec 28-29)

Michael Kitces included my blog post, “Picture one person your work will help,” in his weekly round-up for financial planners (Dec. 27, 2019).

Weekend Reading for Financial Planners (Nov 16-17)

Michael Kitces included my blog post, “Insecure about blogging? Write a letter,” in his weekly round-up for financial planners (Nov. 15, 2019).

Side hustle: holding workshops and teaching online classes

“Interacting with audiences teaches me about my target clients and my target readers,” as I say in a Q&A in ASJA Magazine (for ASJA members only) about my teaching financial professionals how to blog and write investment commentary (Fall 2019).

NAPFA conference highlights generational change and more

“Think your focus on older clients means you can avoid the Uberization of financial advice and your workplace?” Some of the sessions I attended at NAPFA’s fall 2019 conference suggested that you will confront change, as I wrote in the NAPFA Advisor (Nov. 2019)

Helping people prepare for their later years

“The Art of Dying Well: A Practical Guide to a Good End of Life by Katy Butler sounds a bit morbid, but I didn’t find it depressing. It provides many steps people can take in their 50s and 60s to live longer and better. Some of those actions seem commonsense, such as getting to know your neighbors and developing a network of friends. Others actions are less obvious,” as I write in “Helping people prepare for their later years” in the NAPFA Advisor (November 2019).

Regulation Best Interest stirs strong feelings

“It seems as if everybody has an opinion about the SEC’s Regulation Best Interest (Reg BI),” as I say in “Regulation Best Interest stirs strong feelings” in the NAPFA Advisor (September 2019).

Prospects don’t want financial products, but they do want to achieve personal goals

“This gets me to one of my pet peeves about many communications: too much emphasis on ‘we,’ the service providers, instead of ‘you,’ the client or prospect. You may be unintentionally turning away prospects by spending too much time on how great your firm is. In contrast, ‘you’ automatically commands people’s attention because everyone cares most about themselves,” as I say in the NAPFA Advisor (August 2019).

Whom do you call when client data gets hacked?

“Data breaches concern most knowledgeable Americans. That’s especially true for financial advisors because of their access to clients’ sensitive financial information, and because the regulators are increasingly concerned about how well advisors protect that data,” as I write in my article in the NAPFA Advisor (July 2019). My article discusses steps to take once you suspect client data has been hacked.

6 tips to keep your compliance officers happy

The Sondhelm Partners “Insights” page (June 11) shared a link to my recent blog post, “6 tips to keep your compliance officers happy.”

NAPFA members like birthday cards for marketing

“Although many advisors embrace birthday cards, some dislike them,” as I found in my birthday card article for the NAPFA Advisor on the pros and cons of sending birthday cards to clients (June 2019).

2019 NAPFA keynote speeches

Check out the highlights of the NAPFA Spring Conference keynote speeches in the NAPFA Advisor. Dementia may not be inevitable, even if it is in your genes, said Dr. Marc Milstein in one of his two presentations (June 2019).

Raise the profile of your book on Amazon!

I share my three best tips for marketing your book on Amazon in this article for the NAPFA Advisor (June 2019). I learned these strategies from self-publishing Financial Blogging: How to Write Powerful Posts That Attract Clients in 2013.

Five Little Things For Your Monday: April 29, 2019

“If you are a financial advisor, it can be easy to get caught up using financial ‘jargon’ when you are communicating with others,” says this article from Twenty Over Ten, which links to my “Words to avoid in your investment communications with regular folks” for examples of language to avoid (April 29, 2019).

How to act if you don’t recognize someone at the NAPFA Spring Conference

I share four tips for hiding your memory deficit at a conference. The tips appeared in my NAPFA Advisor column (April 2019),

Elaine Pofeldt on Building a Million-Dollar, One-Person Business

I’m quoted in this article in the Freelance Success newsletter (for subscribers only). If you follow my blog, you’ve already learned about Pofeldt’s book in “My 2018 reading, with recommendations for you” (April 4, 2019).

SEC rule proposals dominate advisors’ regulatory and legislative concerns

The SEC’s 2018 rule proposals dominated answers to a NAPFA member survey asking, “What is your top regulatory/legislative concern over the next year?” However, healthcare was also a big concern. My article appeared in NAPFA Advisor (September 2018).

CFP Board General Counsel Rydzewski discusses the revised Code of Ethics and Standards of Conduct

The cornerstone of the revised Code of Ethics and Standards of Conduct is the expanded application of the fiduciary standard, said Rydzewski. My article appeared in the NAPFA Advisor (August 2018).

Advisors tackle elder abuse with education, processes, and awareness

Almost two-thirds of NAPFA members responding to a survey have encountered elder abuse among their clients. They shared their advice on how to respond to potential abuse. My article appeared in NAPFA Advisor (August 2018).

Keep the regulators happy with your firm’s cybersecurity

Keeping your clients safe from fraud is not enough to make the regulators happy with your firm’s handling of cybersecurity. Documenting your policies and procedures is also essential. My article appeared in the NAPFA Advisor (July 2018).

Budgeting and debt management is important, but not a big bottom-line contributor

All the advisors who responded to this survey said that they discuss budgeting and debt management with their clients, but in different ways. My article appeared in the NAPFA Advisor (June 2018).

Disability insurance common, but not always robust enough

More than half of NAPFA members surveyed said that many or most of their clients have disability insurance. The article discusses best practices for disability insurance. My article appeared in the NAPFA Advisor (May 2018).

Environmental investing dominates members’ responsible investments

A survey revealed that responsible investing isn’t a universal concern among NAPFA members’ clients. In addition to reporting survey results, the article shares resources for responsible investors. My article appeared in the NAPFA Advisor (April 2018).

Work smarter, not harder, on your blog

My blog post, “Work smarter, not harder, on your blog,” was republished on SEI’s Practically Speaking blog (March 13, 2018).

Zhush up your blog with these tips from @susanweiner https://t.co/zSM2X8QEQv

— Independent Advisor Solutions by SEI (@SEIAdvisors) March 13, 2018

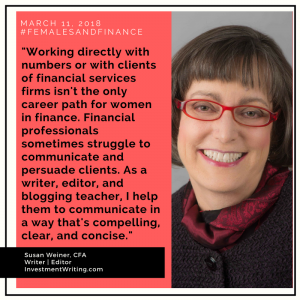

#FEMALESANDFINANCE

I’m featured in the #FEMALESANDFINANCE series on LinkedIn (March 11, 2018).

NAPFA member survey: podcasts for education and marketing

NAPFA members are more likely to listen to podcasts for business than for non-business purposes, according to the results of a member survey. The article discusses how members create and use their podcasts. My article appeared in the NAPFA Advisor (February 2018).

Breaking Money Silence

KBKWealth Connection recognized me in “Check Out These Breaking Money Silence Revolutionaries” as one of three people working to empower clients to talk more about the human side of finance (Oct. 18, 2017).

Healthcare is top legislative or regulatory concern

“Legislation affecting healthcare” took the top spot in NAPFA members’ responses to a survey asking “What is your top regulatory or legislative concern over the next year?” My article appeared in the NAPFA Advisor (Oct. 2017).

How to Pay for 3 or 4 Decades of Less or No Work

Freelance Success wrote, “Financial writer and FLXer Susan Weiner posted this quiz estimating longevity on a Juggler Forum discussion of retirement. Take it. It may make you think twice about how you’re planning and saving” (Aug. 4, 2017).

How to write million-dollar missives

Financial Planning magazine quoted me saying, “Show your personality…. If you can convey something that distinguishes you, you can create a strong relationship before they even pick up the phone” (April 12, 2017).

Blog Post Length: How Long is Too Long?

SEI’s Practically Speaking blog has republished my blog post asking “How long is too long for a blog post”? As SEI’s introduction says, “while blogging is important, you don’t have to write ‘War and Peace’ every time. The post doesn’t have to be long to be good (and helpful) to get your message out there” (April 11, 2017).

Finserv People to Follow

I’m included in the Xtiva blog’s list of “Finserv People to Follow,” along with people like Sheryl Garrett, Michael Kitces, Carl Richards, and Bill Winterberg. The blog says “Follow Susan for tips to improve your writing where it counts – including your client communications and marketing materials” (April 3, 2017).

Financial Writing Best Practices

Advisor Websites interviewed me about financial writing best practices. I discussed how you can achieve the 3 Cs of being compelling, clear, and concise. Plus, I explained my path from Japanese historian to financial writer (March 6, 2017).

Words to avoid in your investment communications with regular folks

My blog post on “Words to avoid in your investment communications with regular folks” was republished on the kbkwealthconnection blog (Feb. 22, 2017). I’m delighted that Kathleen Burns Kingsbury is helping to spread the word about the need for plain language.

Best Blogs to Read for Financial Advisors in 2017

Advisor Websites included my Investment Writing blog as one of the best blogs for financial advisors. Sixteen blogs appear on its list, including The Reformed Broker, Abnormal Returns, and FP Pad (Jan. 19, 2017).

Online Training Tools for Writers

I’m quoted in “Online Training Tools for Writers,” ASJA Magazine (Jan./Feb. 2017)

Top 100 Investment Blogs & Websites For Investors

Feedspot named my Investment Writing blog as one of the “Top 100 Investment Blogs & Websites for Investors.” Blogs were selected on the basis of their Google reputation and Google search ranking; influence and popularity on Facebook, Twitter and other social media sites; quality and consistency of posts; and Feedspot’s editorial team and expert review. Even though my blog isn’t really about investments, it’s an honor to appear with blogs like the CFA Institute’s Enterprising Investor and blogs from companies like Vanguard and Invesco (Jan. 14, 2017).

My Top 5 Tips For Blogging Success As A Financial Advisor

My book and I are mentioned in this article by blogger Michael Kitces (Dec. 29, 2016).

NAPFA Announces New Editor of Advisor Magazine

I’m the new editor of the NAPFA Advisor, a monthly magazine. I’m looking forward to working with the NAPFA staff, members, and authors. The November issue will be the first published under my leadership (Nov. 1, 2016).

John Lothian Newsletter

Referring to “Financial jargon killer: The Wall Street Journal,” the John Lothian Newsletter said, “We read a great deal of financial news to compile this newsletter and provide our readers with the best of the best articles. We have to cull far too many inscrutable articles because they are laden with impenetrable jargon. This particular article was written several months ago but we just came across it and felt it is timeless advice that anyone writing financial articles should heed be it a blogger or Bloomberg” (Oct. 14, 2016).

6 Keys to Finding the Best Blog Posts to Attract Clients

“Starting a blog doesn’t guarantee success, especially if you can’t generate a steady flow of posts with topics that entice readers,” as I say in my guest post “6 Keys to Finding the Best Blog Posts to Attract Clients” on ThinkAdvisor (Sept. 22, 2016).

8 Reasons You Need a Financial Blogging Process

Advisor Perspectives featured my guest post, “8 Reasons You Need a Financial Blogging Process,” on Sept. 19, 2016. If you are struggling with blogging, it may be for one of these reasons.

#CFAwomen — Alpha and Gender Diversity

My tweets are quoted in the CFA Institute’s story about its Alpha and Gender Diversity conference. At the conference, I was struck by the large amount of evidence that diversity contributes to the corporate bottom line. Also, the organization has a Women in Investment Management Initiative. Here’s one of my tweets from the conference:

P Smith: robo advice is positive for our industry. It strips away our ability to confuse our clients about where we add value #cfawomen

— Susan Weiner, CFA (@susanweiner) September 15, 2016

A Goal Buddy Can Boost Your Writing Business

The American Society of Journalists and Authors published my post, “A Goal Buddy Can Boost Your Writing Business” on its blog (Sept. 7, 2016). Do you know the saying, “What’s measured gets done”? Perhaps that’s why my buddy and I started doing quarterly reviews. Even if you’re not a writer, you may find tips you can adapt to your business.

'Celebrating the good things about our lives is a regular part of my goal-buddy routine'. Great piece! @susanweiner https://t.co/QDAMemHcIq

— ASJA (@ASJAhq) September 8, 2016

The Most Influential Women in Finance on Twitter

I am on a list of the 100 most influential women in finance on social media (August 1, 2016). Kurtosys ranked members by their Klout score.

The women to follow all year-round on financial Twitter

I’m listed in this NexChange article about women worth following on Twitter (June 2016).

For #FollowFriday check out wealth management guru @susanweiner, one of our top #women on #finance twitter! https://t.co/OG4Vgslu75

— NexChange (@NexChanger) July 29, 2016

8 Tips for Creating Financial Blogs that Attract Clients

“This post is a must read and Susan is a must follow on social media for any advisor who is trying to grow their businesses,” says John Anderson in his introduction to my guest post on SEI’s Practically Speaking blog (June 2, 2016). Sept. 2020 update: My guest post is no longer online at this site.

Five Writing Mistakes that Sabotage Your Investment commentary

Advisor Perspectives featured my guest post, “Five Writing Mistakes that Sabotage Your Investment Commentary,” on May 19, 2016. Are YOU making any of the mistakes that I discuss? For example, if your investment commentary simply says the stock market did this and the bond market did that, nobody will care.

Are Financial Predictions Too Risky To Put In Manager Letters?

A slightly revised version of “Are financial predictions too risky for investment commentary writers?” appeared in Hedge Fund Insight (May 5, 2016), a U.K. publication.

Self-publishing Insights and Tips

Learn tips from self-published authors, including me, in this interview on The Writer’s Place (May 3, 2016).

CompliancE-news features two writing tips

Two of my articles, “Stop saying ‘Click here’!” and “Write so technical topics are easy to understand,” are excerpted in Nancy Lininger’s CompliancE-news (April 29, 2016).

5 Steps to Writing Better Investment Commentary With Less Pain

Would you like better results from your investment commentary while suffering less pain as you write? Follow the five-step process I describe on ThinkAdvisor (April 8, 2016).

Weekend Reading for Financial Planners (Apr 9-10)

Michael Kitces includes my post on “How to edit your financial firm’s bios” in his weekly round-up for financial advisors. Check out his round-up for more useful links.

Public Speaking for Writers

I’m presenting on a panel to members of the American Society of Journalists and Authors (ASJA) on April 27. If you’re a local ASJA member, you should have received an email notification.

Marketing Tips, Part 2: Work That Newsletter

My strategy for marketing through monthly and weekly newsletters is featured in the Freelance Success newsletter (April 7, 2016).

Paying It Forward With Scholarships

Learn how to honor your loved ones with scholarships. Read “Paying It Forward With Scholarships” in Vested (Winter 2016).

Stop Doing This — and Boost Financial Blogging Productivity

Would you like to increase your financial blogging productivity? Stop doing this one thing and you’ll produce more blog posts with less effort and more fun, as I say in my guest post on the XY Planning Network blog (Feb. 11, 2016).

Weekend Reading for Financial Planners (Dec 26-27)

“For all those financial advisors struggling to figure out what to write about on their company blog, Weiner offers up a remarkably simple and straightforward approach,” says Michael Kitces, writing about my blog post, “Blogging the mistakes your clients make” (Dec. 25, 2015).

Getting the Data Right in Investment Commentary: An Interview with Susan Weiner, CFA

If you make data mistakes in your investment commentary, learn from the mistakes and improve your process so you don’t make the same mistakes again. That’s one piece of advice from my interview on the Synthesis Technology blog (Dec. 17, 2015).

ECB Chief Mario Draghi Loses, and Regains, His Magic

Barron’s quoted my blog in its Dec. 5 issue. Remember my discussion of how financial advisors could benefit from the example of Donald Trump’s using language at a low-grade level? In “ECB Chief Mario Draghi Loses, and Regains, His Magic” (subscription required), Randall Forsyth suggested that Mario Draghi should also communicate more clearly. Here’s an excerpt from what he wrote quoting me:

Most financial writing is aimed at readers with an educational attainment above the 12th grade—high school graduates and those with some college—which “may be too high for audiences with short attention spans.” To rectify this shortcoming, she suggests using www.hemingwayapp.com, which rates your writing for complexity and highlights sentences that might challenge readers’ erudition or lack of it. Indeed, it urges you to avoid long sentences (such as the previous one.) So, it should come as no surprise that my most recent column on Barrons.com was deemed to be at a 14th grade, or college, level—clearly unacceptable by current standards.

Your Idea of Effective Comms Might Not Be What Works

“The way an advisor phrases an email or a blog post can send important messages to clients or readers,” as I say in “Your Idea of Effective Comms Might Not Be What Works” on Financial Advisor IQ (Nov. 16, 2015).

Keeping Family History Alive

The motivation for researching family genealogy varies greatly among families. Regardless of your motivation, you can learn more about the process in my article, which appeared in Vested (Fall 2015).

CFA Institute’s Fixed Income Conference

Many of my tweets from the CFA Institute’s Fixed Income Conference are quoted in “#CFAFI – Fixed-Income Management 2015.” You’ll recognize tweets from my headshot photo and Twitter name (Oct. 24, 2015).

Seven Essentials for Modern Advisor Marketing

My blog is one of the “Seven Essentials for Modern Advisor Marketing.” “It’s packed with blog topic ideas, writing tips, and other helpful content specifically written for financial services professionals who want to make an impact with their marketing content,” says the eMoney Advisor Blog (Oct. 22, 2015).

Investment Reporting for Corporate and Media Writers

I was interviewed by ProfNet for their #ConnectChat on “Investment Reporting for Corporate and Media Writers.” The interview is featured on ProfNet’s blog (Oct. 14, 2015). ProfNet put my photo on an electronic billboard in Times Square to highlight my participation.

6 Things You’re Saying to Yourself That are Holding You Back

My advice to a fellow writer was featured in “6 Things You’re Saying to Yourself That are Holding You Back” on the Psychology Today blog (Sep. 29, 2015).

One easy fix to get more market commentary readers

My blog post, “Tweet your quarterly investment commentary for more impact” is highlighted in “One easy fix to get more market commentary readers” on Sunstar Strategic’s FundFactor blog (Aug. 24, 2015).

It’s Difficult to Make Predictions, Especially About the Future

My blog post, “Are financial predictions too risky for investment commentary writers?” is highlighted in the beginning of “It’s Difficult to Make Predictions, Especially About the Future” on David Merkel’s Aleph Blog (July 18, 2015).

Insights from Alternatives Best in Boston

Some of my tweets from a round of live-tweeting were highlighted in “Insights from Alternatives Best in Boston” (July 20, 2015).

Improving Your Investment Commentary

Tom Brakke, whom you may know from The Research Puzzle blog, wrote about tips from my webinar in “Improving Your Investment Commentary” on the CFA Society Minnesota blog (July 14, 2015).

Content Marketing for Banks: Insights From a Financial Content Expert

“Don’t let compliance issues become an excuse for mediocre content. Heed these tips from author and financial services expert Susan Weiner,” says Ryan Johnson in an article that appeared on the Imagination Publishing blog (July 1, 2015).

Is a Vacation Home Alternative Right for You?

There are alternatives to traditional vacation home ownership that offer advantages over making hotel reservations. Learn about alternatives including hotel-affiliated vacation clubs, in my article, which appeared in Vested (Summer 2015).

The Art of Collection

Susan’s article, “The Art of Collection,” appeared in Vested (Winter 2015). It discusses how people can start collecting art, especially once retirement frees time for them to pursue their passions.

Tone in Shareholder Letters Impacts Flows: Study

Susan is quoted about writing tips for portfolio managers in a 929 Media article (subscription required) discussing a study called “Mutual Fund Shareholder Letter Tone — Do Investors Listen?” (Feb. 9, 2015).

Party On, Evidence-Based Advisors: 2015 Communication Resources: Part(y) One

“Susan’s book, presentations and publications are worthy resources for those who prefer to write their own content (especially blog posts) but could use some practical bursts of inspiration to improve on the form and substance of their work,” says Wendy J. Cook in “Party On, Evidence-Based Advisors: 2015 Communication Resources: Part(y) One” on her blog (Feb. 8, 2015).

Say What You Mean

Susan is interviewed about effective written communications, especially email, on the Women Rocking Wall Street podcast with Sheri Fitts.

Math at Work Monday: Susan Weiner the Chartered Financial Analyst

Susan is interviewed about her use of math in writing investment performance reports in this Q&A on the Math for Grownups blog (Jan. 12, 2015).

6 Things You’re Saying to Yourself That Are Holding You Back

Susan is quoted about networking in this article on The International Freelancer (Jan. 9, 2015).

Content Marketing: 8 Essential Tips for Fund Marketers

Win the investment marketing game with Content Marketing: 8 Essential Tips for Fund Marketers‘ tips from five contributors, including Susan (Dec. 2014).

Susan makes her debut as an elf

Susan’s gift recommendation for investment marketers appeared in “What To Give The Mutual Fund, ETF Marketer—9 Elf-perts Weigh In” on the Rock the Boat Marketing blog. You can also see a picture of Susan—and eight other experts—wearing elf caps (Dec. 4, 2014).

November Recommended Reading

Scottrade Advisor Services’ newsletter named Financial Blogging: How to Write Powerful Posts That Attract Clients as its November recommended reading (Oct. 31, 2014).

4 Tips for Turning Investment Commentary into Blog Posts

“4 Tips for Turning Investment Commentary into Blog Posts” is my guest post on the Synthesis Technology blog (Oct. 23, 2014). I have four main tips for asset managers who want to get more mileage out of their investment commentary by sharing it on their blogs.

Financial Blogging continues to gain five-star review on Amazon

“This book is enlightening, practical, thorough, clear and results-oriented,” says a recent review on Amazon.com (Oct. 22, 2014). Another reviewer says, “As a financial advisor I wanted to start blogging but I didn’t know how. I invested the money in Susan’s book. It’s helped me tremendously!” You can read more reviews on Amazon.

Ten Key Elements For Better Online Writing

To take advantage of the opportunities posed by online writing, use 10 tips from Susan’s Financial Blogging, says Mike Byrnes in this Financial Advisor article (Sept. 30, 2014)

CFA Institute Society Leaders are Talking

Yes—You Too Can Be a Big-Shot Blogger!

If the thought of blogging makes you as nervous as an executive facing an IRS audit, stop worrying. You can overcome your challenges with these tips from my guest post on the AccountingWEB blog (Aug. 12, 2014).

11 Must-Follow Twitter Feeds for Financial Advisors

“Sharing content with clients and prospects on websites, social media and blogs is becoming an important component of the financial advisory business. Susan Weiner’s differentiator is that she helps financial professionals increase the effectiveness of their content,” says The New Age of Advice, a blog by Transamerica (July 21, 2014).

How to Decode Your Financial Advisor’s Jargon

“If you’re looking up terms when you get home from a visit with your advisor, that’s a bad sign,” as I say in this article on the USNews website (July 17, 2014).

Perfecting Your Copy: Tips for Bullet Proofing Your Words

My use of Adobe Acrobat Pro is highlighted in an article about proofreading in The ASJA Monthly (July/August 2014). The article isn’t online, but you can read my proofreading tip on my blog.

Follow Friday: Natascha Thomson, Susan Weiner, Gwen Moran

“Even if you’re not a financial advisor, I recommend following Susan on social media. She shares all sorts of great writing- and blogging-related tips and links that anyone can benefit from,” says Elizabeth Kricfalusi on the TechForLuddites blog (June 6, 2014).

How to live-tweet a financial conference

My post on “How to live-tweet a financial conference” was included in “Adam Sandler, Tortoise and the Hare, & Warren Buffett – #Blueleafing Roundup” of notable blog posts for financial advisors on the Blueleaf blog (June 6, 2014).

Don’t Sabotage Your Website’s News Page

“A news page featuring your firm’s mentions in the media can boost your credibility as long as you avoid one financial advisor’s mistake,” as I explain in this guest post on the Beck Law Firm blog (May 15, 2014).

Book Review: Financial Blogging

The New York Society of Security Analysts featured the CFA Institute review of Financial Blogging in The Finance Professional’s Post (May 12, 2014) and in its May 2014 member newsletter.

Secrets of a speedy sale via Twitter

“I sent a tweet asking for new clients. It worked almost like magic.” Learn my secrets by reading my guest post for John Refford’s socialmktgtech.com blog(April 26, 2014).

A-Z Guide of Asset Management Marketing

“Your content is useless if people ignore it. You must engage them. Create content that focuses on your target audience’s needs. Make it easy to consume. Ask for feedback. The engagement that results will deepen your relationships with asset management clients and prospects,” as I say in the A-Z Guide of Asset Management Marketing, published by Kurtosys (registration required, April 2014).

Expert Interview with Susan Weiner on Writing Better

“Financial professionals have great information to share, but sometimes they get so excited about the technical details that their writing isn’t reader-friendly,” as I say in my Q&A on the Reputation.com blog (March 26, 2014).

Financial blogging tips

Learn about my “8 Top Tips for Creating Financial Blogs That Attract Clients” (for subscribers only) on Horsesmouth (March 19, 2014). Editor Sean Bailey’s interview with me is available to non-subscribers.

The Independent Advisor’s IMPLEMENT NOW! Practice Management telesummit

Kristin Harad interviewed me about effective writing techniques (March 18, 2014) on this telesummit featuring 21 practice management experts.

Financial services influencers that you need to know online – and why

I’m number 40 on a list of 250 “Financial services influencers that you need to know online,” according to Jay Palter Advisory’s analysis using Little Bird (March 4, 2014).

Susan Weiner on How To Write Financial Planning Articles That Attract Clients

Abraham Okusanya of AdviserHangout shares his writing tips and interviews me about how advisors can improve their writing (March 4, 2014).

4 Tips for Better Financial Blogging

“You don’t need to be a perfect writer to be a great blogger,” as I say in one of my many quotes in an RIACentral article (Feb. 10, 2014).

Book Review: Financial Blogging

“This book will improve your blogging. It will sharpen what you write about, the frequency at which you write, and how you write. This is a great book for financial bloggers,” says David Merkel on The Aleph Blog (Jan. 24, 2014).

5 tips that make financial blogging easy

Susan’s article, “5 tips that make financial blogging easy,” appeared on LifeHealthPro (Jan. 24, 2014).

Book Review: Financial Blogging: How to Write Powerful Posts That Attract Clients

“Susan Weiner, famous among CFA societies for her effective-writing workshops, has produced a powerful reference guide that should become the single best source for assisting independent and fee-only advisers in their blogging activities. The lessons contained in Financial Blogging: How to Write Powerful Posts That Attract Clients are highly accessible. Through exercises and outlines, reinforced with a workbook-style appendix, the reader quickly learns what it takes to accomplish excellent short-form communication,” says reviewer Janet Mangano in her review of Financial Blogging, which appeared on the CFA Institute’s Enterprising Investor blog (Jan. 16, 2014).

The RIABiz top 10 industry blogs — and which bloggers they recommend

Susan made the list of top 10 blogs for the RIA business. “Weiner is one of the best in this industry in part because of her consistent and passionate approach,” says the RIABiz article (Jan. 14, 2014).

2014 Resolution: This Year, I Will Blog

“Book on financial blogging offers a step-by-step guide, and practical solutions to common problems,” says ThinkAdvisor in its interview with Susan about blogging (Dec. 19, 2013).

Write More Effective Communications

Susan’s tips for more effective emails are discussed in this Financial Advisor article by Mike Byrnes (Dec. 13, 2013).

Book Review: Financial Blogging: How to Write Powerful Posts That Attract Clients

“It is a terrific guide for financial advisors who have not done a lot of writing. Though I got some ideas from it as well,” says Stephen Wershing in “You Should be Blogging—And Here is a Great New Guide to Help You Get Started” on The Client Driven Practice blog (Dec. 12, 2013).

Writing in Business: Tips for Blogging Effectively

Susan shares her tips for powerful writing that attracts new clients and deepens your relationships with existing clients in a Q&A on DerivSource (Dec. 10, 2013).

If you want to blog, but you’re not sure what to say…

In “Nothing to share?” in the Marketing Minute newsletter, Marcia Yudkin recommends Susan’s Financial Blogging book as a resource for advisors who ask, “Why would anyone want to listen to me?” (Nov. 20, 2013).

My Relentless Crusade Against Jibber-Jabber

“For those FrazerRice.com readers slaving away in worlds of finance and law, this short piece by Susan B. Weiner at InvestmentWriting.com about what can sometimes feel like burdensome ‘Plain English’ compliance requirements, deserves a few moments of your time,” says Frazer Rice on his blog (Nov. 20, 2013).

3 Ways to Make Your Investment Writing More Effective

Susan shared her best tips for engaging clients and prospects with your market commentary, newsletters, and performance reports on the ByAllAccounts blog (Nov. 13, 2013).

7 Ways to Talk Your Financial Execs Out of Jargon and Bad Writing

Susan’s tips on winning over your subject-matter experts appeared on the MarketingProfs blog (Oct. 18, 2013).

9 Smart financial bloggers you need to know

“If you’re trying to cut through the noise with your own blog writing, Susan will help inspire you to greatness,” says Jay Palter in this post on the LifeHealthPRO blog (Oct. 18, 2013).

What Twitter says about your financial adviser

“…advisers are posting their own tweets and blogs but learning the trade from subject matter experts, including Susan Weiner, author of ‘Financial Blogging: How to Write Powerful Posts That Attract Clients,’ ” says Bob Powell in his Retirement Portfolio column on MarketWatch.com (Sept. 14, 2013).

Going from “Huh?” to Sales with Informational Interviews

Susan is quoted extensively on how to use informational interviews to develop corporate writing clients in the subscriber-only Freelance Success newsletter (Sept. 13, 2013).

Press Release: Financial Blogging: How to Write Powerful Posts That Attract Clients

“It’s tough for financial advisors to stand out in a world of lookalike products and services. A leading consultant on financial advisor communications says blogging is a great way for them to display the personality and expertise that spur referrals and new clients.” (August 1, 2013)

Book Review: Financial Blogging: How to Write Powerful Posts That Attract Clients

“What this book does is help you write good blog posts, after you’ve decided to be a blogger,” says Nancy McCarthy in her review of Susan’s book in The Value Examiner. (July/August 2013).

Seven Resources to Make You a Better Writer

“Writer, editor and Chartered Financial Analyst Susan Weiner’s blog offers writing tips tailored to those in the financial industry. Her new book, Financial Blogging: How to Write Powerful Posts That Attract Clients, is also a must-read for financial advisors who blog (or who are thinking about doing so),” says Megan Elliot on the Wealth Management Marketing blog (September 4, 2013).

Spreading the Word

How ETF issuers can use social media is the topic of this IndexUniverse article by Ann Logue, which quotes Susan extensively (August 26, 2013).

How virtual assistants can support adviser blogs

Susan’s guest post about virtual assistants was picked up by the Financial Planning Association’s FPA SmartBrief (August 26, 2013).

Weekend Reading for Financial Planners (August 24-25)

“If you’ve been thinking about launching a blog for your advisor website, or are looking for some tips and ideas of how to do it better, you may want to check out the list of Susan’s articles for some inspiration (and I recommend her book, too!),” says Michael Kitces on Nerd’s Eye View (August 24, 2013).

Financial Services Professionals: Do You Want to Blog But Don’t Know How?

“In her new book, Financial Blogging: How to Write Powerful Posts That Attract Clients, Susan B. Weiner, CFA, teaches financial services professionals how to craft a blog that is effective and makes you shine,” says Kathleen Burns Kingsbury on the kbk wealth connection blog (August 13, 2013).

Quantitative Easing for Regular Folks: Three Lessons from the New York Times

Susan’s article, “Quantitative Easing for Regular Folks,” was reprinted by Advisor Perspectives (August 13, 2013).

A (NEW) Guiding Light for Financial Bloggers

Financial Blogging: How to Write Powerful Posts That Attract Clients “will be one of the best investments you’ll make this year,” says Wendy Cook in her book review. “It walks you through clear, manageable steps for financial blogging” (August 6, 2013).

“Blog Stories: Another 1,000-post blogger shares her success”

The Investment Writing blog is the focus of this post on WordCount: Freelancing in the Digital Age blog (August 6, 2013).

“Thought leaders for financial services social media”

Susan’s “practical insights for advisors and financial marketers engaged in the content development process” landed her on Jay Palter Social Advisory’s list of thought leaders (August 1, 2013).

“10 Best Finance Tweets of the Month: July”

One of Susan’s tweets was selected by ThinkAdvisor as a top tweet of July (August 1, 2013).

How using Google Images can cost you $8,000 http://t.co/sLNHG5zawm via @PRDaily @michaelkitces

— Susan Weiner, CFA (@susanweiner) July 29, 2013

“How to produce great written content for your clients”

“Financial services writing expert Susan Weiner provides a great piece full of practical tips and suggestions for anyone writing about complex topics to clients,” said Tony Vidler’s newsletter about Susan’s “Ideal quarterly investment letters: Meaningful, specific, and short” (July 14, 2013).

“Top 10 Websites for Advisors and How to Use Them”

“Susan Weiner offers valuable advice and tips on how to be a better writer and improve communications with clients,” according to this post on The Trust Advisor (June 24, 2013).

“Au revoir”

“Anyone in the financial services industry who aspires to write a successful blog should subscribe to Susan Weiner’s www.investmentwriting.com and consistently follow her advice,” said Philip N. Lawton in a footnote to his final post on The Middle Office before he takes his blog offline in July (June 16, 2013).

“Advisor survey reveals favorite news and blog sites”

The Investment Writing blog ranked in the top 10 of blogs popular among financial advisors, according to a survey conducted by Zywave. To see the ranking, you’ve got to open the .PDF file of complete survey results and go to page 5 (June 12, 2013)

“Use your blog to get clients for corporate writing work”

Susan’s guest post appeared on the WordCount blog (June 11, 2013)

“Susan Weiner and Her Financial Blogging Brain Center”

News about Susan’s forthcoming book and her post, “Boost your blog with original photos: The SAGE Advisory example,” appeared on the Wendy J. Cook Communications blog (June 3, 2013).

“What Financial Advisors Are Tweeting”

Financial Advisor IQ’s roundup included Susan (June 3, 2013).

The Wall Street Journal‘s Wealth Manager blog

In its “Morning Call,” the blog linked to Susan’s post on “How to help your clients help their aging parents” (May 24, 2013).

“How to Stop Jargon From Pulling the Plug Out of Your Powerful Content”

In this Content Marketing Institute piece, Susan is quoted on why you should avoid jargon (April 29, 2013).

“Attract Clients with Your Writing” on WealthChannelTV

WealthChannelTV named the Investment Writing blog its “blog of the week” on April 25, 2013.

“5 tips for finding ghostblogging clients” on WordCount

Susan is quoted in Marcia Layton Turner’s April 23 article.

“Top 10 investment Twitter accounts to follow” on the totalasset blog

The totalasset blog named Susan’s Twitter account (@susanweiner) one of the “Top 10 investment Twitter accounts to follow” on April 22, 2013.

“Q&A format for articles: Good or bad?” on Ragan.com

“Q&A format for articles: Good or bad?” on Ragan.com

“Q&A format for articles: Good or bad?” was republished with permission on Ragan.com on April 12, 2013. Susan’s article originally appeared on the Investment Writing blog.

Yes, that’s really Susan’s photo on a Times Square billboard

Susan was the featured guest on ProfNet’s #ConnectChat Twitter chat on March 3, 2013. She tweeted for journalists who’d like to shift into corporate writing. One cool thing was that her picture was posted in the Reuters billboard in Times Square as part of the chat promotion. The Twitter chat was summarized on the ProfNet blog as “How Writers Can Break Into the Corporate Market.”

Leave a Reply

Want to join the discussion?Feel free to contribute!