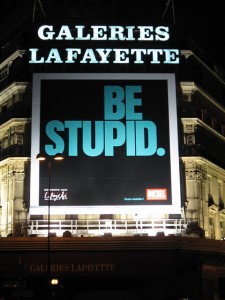

Advertising makes you stupid–even if you’re smart or rich

Highly educated and wealthy investors make dumb mistakes.

This is my oversimplified take on one section of “Mutual Funds: Advertising, Behavioral Models, and Investor Choice,” an article by John Haslem, which appeared in the Spring 2011 issue of The Journal of Index Investing.

“There is a strong positive relation between advertising and investor dollar allocations,” says Haslem’s article, which appears to be a review of other authors’ literature on his topic.

Smart and rich, yet dumb

Advertising emphasizes past performance and rarely discusses fees outside the fine print, so this provides a backdrop to Haslem’s assertion that

- Highly educated and wealthy investors underweight fund fees and give more attention to past performance.

- Financially savvy investors underweight fund fees

and give more attention to short-term performance.

Surprising, isn’t it? You’d think that wealthy investors would take the time to educate themselves and that highly educated investors would understand the importance of expenses to fund returns.

To dig below the surface of this finding, read the source cited by Haslem: Ronald T. Wilcox’s “Bargain Hunting or Star Gazing? Investors’ Preferences for Stock Mutual Funds,” The Journal of Business (October 2003).

Financial writer’s tips

- If you’re a financial blogger or newsletter writer, the provocative assertions in Haslem’s article would make a great takeoff point for an article. For example, you could share how your experience compares.

- The Finance Professionals’ Post, published by New York Society of Security Analysts (NYSSA), is a good place to find tidbits to inspire your writing. I found Haslem’s article in the blog’s “Recent Research: Highlights from March 2011.”

- If you’re an NYSSA member, you can pick up more writing tips when I speak on “How to Write Investment Commentary People Will Read” on April 28. It’s FREE for NYSSA members.